GST Rates in India 2025 – Complete List & Updates

Goods and Services Tax (GST) rates are vital for every Indian business and consumer. Changes in GST rates can significantly affect various industries and the economy as a whole. Understanding the latest GST rates is essential for seamless transactions, whether you are a trader, consumer, or service provider.

Understanding GST Rates

GST rates represent the percentage of tax imposed on the sale of goods and services under the CGST, SGST, and IGST Acts. For instance, if a product has a taxable value of ₹10,000 and a GST rate of 12%, the GST charged would be ₹1,200.

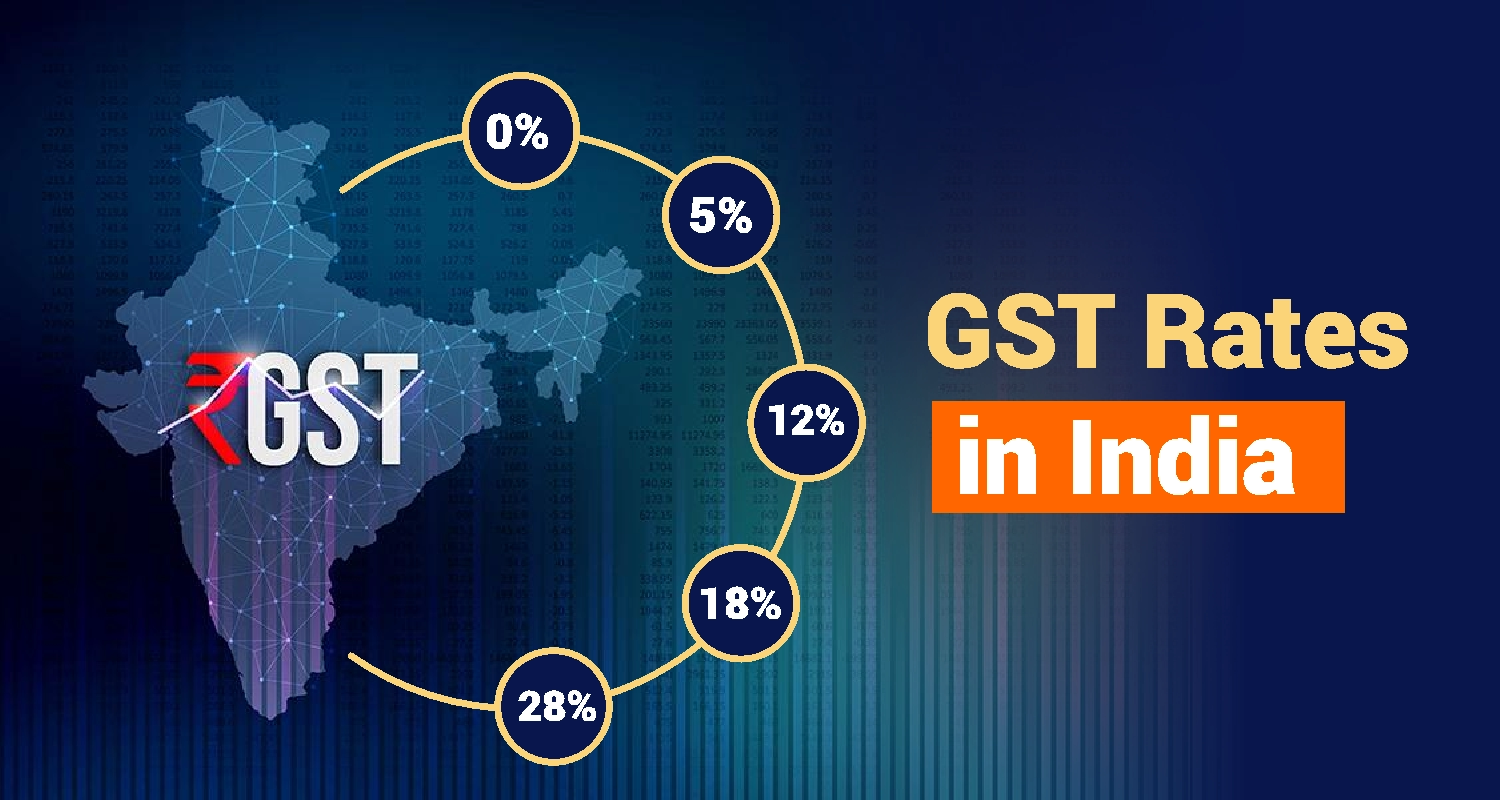

GST Rate Structure in India 2025

The GST slab rates structure is primarily categorised into five main GST slabs:

- 0% GST: Essential goods like fresh fruits, vegetables, milk, and educational services.

- 5% GST: Basic household items such as sugar, spices, edible oils, and dining at small restaurants.

- 12% GST: Processed foods, textiles, and mobile phones.

- 18% GST: Most goods and services, including electronics, restaurants (with AC), and financial services.

- 28% GST: Luxury items such as cars, high-end motorcycles, and aerated drinks.

Check out the slab rates below:

| Category | Old GST Rates | New GST Rates |

|

Scrap and polyurethanes |

5% |

18% |

|

Pens |

12% |

18% |

|

Metal Concentrates and Ores |

5% |

18% |

|

Recorded media reproduction and print |

12% |

18% |

|

Packing containers and boxes |

12% |

18% |

|

Certain Renewable Energy Services |

5% |

12% |

|

Broadcasting, sound recordings, and licensing |

12% |

18% |

|

Printed materials |

12% |

18% |

|

Railways Goods and Parts under Chapter 86 |

12% |

18% |

Sapna aapka. Business Loan Humara.

Apply NowHow GST Rates are Decided?

GST rates are determined by the GST Council, which considers various factors, including the nature of goods and services, their impact on the economy, and the need for revenue generation. Regular reviews and revisions ensure that GST rates align with current economic conditions.

Impact of GST Rates on Different Sectors

Different sectors experience varying levels of impact due to GST percentage in India. For example:

- Agriculture: Lower rates on essential goods help keep prices affordable.

- Manufacturing: Higher rates can increase production costs, affecting pricing.

- Service Industries: The applicable GST rates influence services like hospitality and banking.

TDS under GST & TCS under GST

- TDS under GST (Tax Deducted at Source): Applicable to specified transactions, where a buyer deducts a tax percentage before making payments to the supplier. It primarily applies to government entities and large corporations.

- TCS under GST (Tax Collected at Source): Applicable to e-commerce operators collecting tax from sellers on their platform. It ensures better tax compliance and transaction tracking.

Common GST Rate Misconceptions

Many misconceptions surround GST rates. A common belief is that higher GST rates always result in higher consumer prices. However, the actual impact can vary due to market conditions and competition, which may absorb some of the tax increases.

Additionally, some individuals assume that all goods are taxed uniformly, but this is not the case. GST rates differ significantly based on the classification of goods and services, with essential items often taxed at lower rates and luxury goods facing higher rates. Understanding this nuance is crucial for consumers.

How to Check GST Rates for Products and Services?

Consumers and businesses can check the new GST rate list by searching various HSN codes, SAC codes, and GST rate finders. These tools provide up-to-date information and help identify the correct GST applicable to specific products or services.

Conclusion

Understanding GST rates, GST tax slabs, and the GST law is crucial for effective financial planning and compliance. With the recent updates from the GST Council, staying informed helps businesses and consumers navigate the tax landscape efficiently while ensuring adherence to the latest regulations.

FAQs

Q1. What is the GST rate for essential goods?Ans. Essential goods, such as fresh fruits, vegetables, and educational services, are typically taxed at a 0% GST rate, ensuring consumer affordability and supporting basic needs.

Q2. How often are GST rates revised?Ans. GST rates are revised during GST Council meetings, which are held periodically throughout the year. These revisions reflect changes in economic conditions and aim to optimise tax structures.

Q3. Can GST rates vary for interstate transactions?Ans. Yes, for interstate transactions, GST rates are governed by IGST, which combines both CGST and SGST rates. This structure ensures proper tax distribution between central and state governments.

Sapna aapka. Business Loan Humara.

Apply NowDisclaimer: The information contained in this post is for general information purposes only. IIFL Finance Limited (including its associates and affiliates) ("the Company") assumes no liability or responsibility for any errors or omissions in the contents of this post and under no circumstances shall the Company be liable for any damage, loss, injury or disappointment etc. suffered by any reader. All information in this post is provided "as is", with no guarantee of completeness, accuracy, timeliness or of the results etc. obtained from the use of this information, and without warranty of any kind, express or implied, including, but not limited to warranties of performance, merchantability and fitness for a particular purpose. Given the changing nature of laws, rules and regulations, there may be delays, omissions or inaccuracies in the information contained in this post. The information on this post is provided with the understanding that the Company is not herein engaged in rendering legal, accounting, tax, or other professional advice and services. As such, it should not be used as a substitute for consultation with professional accounting, tax, legal or other competent advisers. This post may contain views and opinions which are those of the authors and do not necessarily reflect the official policy or position of any other agency or organization. This post may also contain links to external websites that are not provided or maintained by or in any way affiliated with the Company and the Company does not guarantee the accuracy, relevance, timeliness, or completeness of any information on these external websites. Any/ all (Gold/ Personal/ Business) loan product specifications and information that maybe stated in this post are subject to change from time to time, readers are advised to reach out to the Company for current specifications of the said (Gold/ Personal/ Business) loan.