Letter of Authorization for GST: A complete Guide

As we are all well aware, a letter of authorization is a legal document that assigns a third party (mostly an employee) the responsibility for carrying out business operations on behalf of the company/firm and its owner. A letter of authorization can be used in various situations and for various business purposes. Let’s find out how the letter of authorization works within the world of Goods & Service Tax (GST) System.

What is a Letter of Authorization for GST?

In order to carry out routine business-related transactions as per GST laws, a letter of authorization for GST is an absolute must. In a firm, the person responsible for managing the GST proceedings has to often fill the forms themselves or pay a visit to the GST office. Now since` they do not own the particular business, the officers at the GST department need to know if they are genuinely in charge of the accounting and represent the business. Usually, it is the employee of the office. To ensure his/her credibility as the representative of the business/company, a letter of authorization is needed to be signed by the owner of the company. The person who has been given this authority to act on behalf of the firm/company is known as “Authorized Signatory”.Why is the Letter of Authorization for GST needed?

Usually, for most of the business entities excluding sole proprietorships or sole-ownership businesses, a letter of authorization for GST is required to carry on day-to-day GST work in a firm/company. Even a sole proprietorship firm can give a Letter of Authorization to its employee to handle routine GST work of the firm. The Letter of Authorization is required for the following purposes under GST:-

- 1. To register under the GST Act.

- 2. To amend or cancel registration under the GST Act.

- 3. To sign documents such as GST Returns, invoices, and other GST forms for uploading on the GST website or physical submission to the GST department.

- 4. To respond to notices or queries/clarifications from the GST department.

- 5. To engage in any other correspondence with the GST department on behalf of the firm/company.

Sapna aapka. Business Loan Humara.

Apply NowCrafting the Letter of Authorization for GST:

While the GST Act doesn’t prescribe a fixed authorization letter format, certain factors must be considered. Certain key elements must be included. These include details such as the registered name of the business, address of the firm, contact details, taxpayer’s name, authorized signatory names, Aadhar and PAN details, and the date, place, and signatures. While drafting this letter, it is absolutely necessary that the letter is issued on the company’s official letterhead.

Letter of Authorization for GST Registration

During the application for GST Registration (Reg -1 form), details of the Authorized Signatory of the firm/company are mandatory, such as name, address and other relevant information.

The Authorization Letter has to be uploaded in PDF format along with the Application form of Registration on the GST Portal.

When it’s a sole proprietorship, any additional authorized signatory is not mandatory. The proprietor himself/herself can be the authorized signatory.

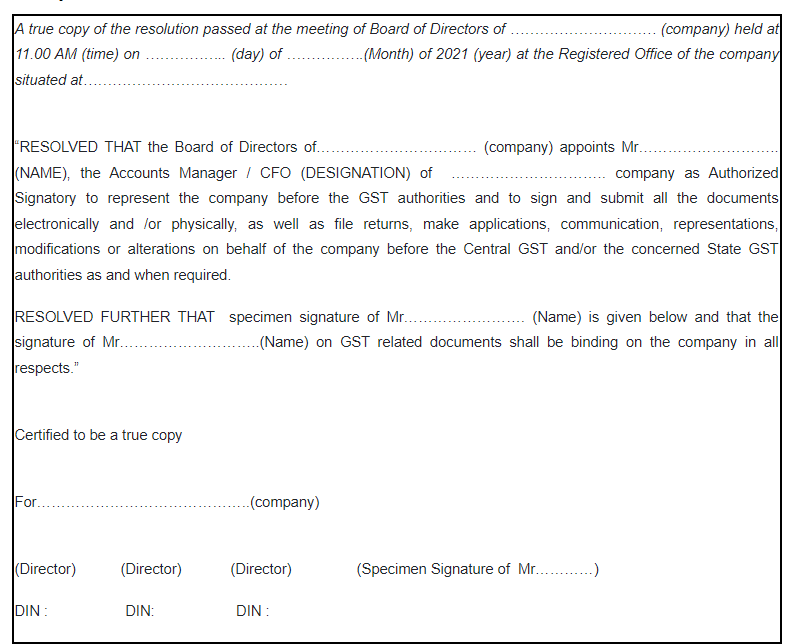

For companies (Public, Private, or One Person), the GST Authorization Letter must be accompanied by a copy of the Board Resolution.

Both the Board Resolution and the Authorization Letter must be uploaded on the GST Portal.

In the case of Partnership firms, the Authorization Letter should be signed by all partners.

Any Director of the company or any Partner of the firm can serve as an Authorized Signatory.

Letter of Authorization for GST by a Proprietor

If a person is carrying out business on an individual basis in his name or in the capacity of sole proprietorship, they are not expected to file any letter of authorization on the GST portal. Whether it is at the time of registration or the appointment of a third party as his authorized signatory. However, if the proprietor chooses to appoint a third party as their Authorized Signatory for GST purposes, then they will have to file a Declaration for Authorized Signatory in the same format as already given above. Sole proprietorship firms usually prefer to give a Letter of Authorization to their employees/any other person for smooth compliance of GST Law.

Authorization Letter Sample

Conclusion

The Letter of Authorization for GST transcends its role as a mere procedural requirement. Beyond its significance in GST-related transactions, it is a linchpin for various business activities, underscoring its importance in the broader spectrum of business operations. This article aims to comprehensively understand the nuances surrounding the GST authorization letter, ensuring businesses navigate this essential aspect of regulatory compliance with clarity and confidence.

FAQs

1. What is a letter of authorization?Ans. A letter of authorization is a legally binding document that delegates a third party, usually an office employee, the task of conducting business operations on behalf of the company/firm. This person becomes the authorized signatory, and their actions are binding on the company.

2. What is the need to appoint an authorized signatory?Ans. When there are multiple individuals owning a particular business, a segregation of responsibilities is required for things to run effectively and smoothly. In such cases appointing an authorized signatory to handle GST-related proceedings helps owners to focus on other aspects of the business while ensuring legal compliance.

3. Is there a prescribed GST-authorized signatory letter format in the GST Act?Ans. The GST Act does not mandate a particular format for the authorized signatory letter. However, a valid letter should include important details such as the company's name, the name of the partner, director, or owner, and the name of the authorized signatory, accompanied by their designation. An acceptance declaration should also follow the letter.

Sapna aapka. Business Loan Humara.

Apply NowDisclaimer: The information contained in this post is for general information purposes only. IIFL Finance Limited (including its associates and affiliates) ("the Company") assumes no liability or responsibility for any errors or omissions in the contents of this post and under no circumstances shall the Company be liable for any damage, loss, injury or disappointment etc. suffered by any reader. All information in this post is provided "as is", with no guarantee of completeness, accuracy, timeliness or of the results etc. obtained from the use of this information, and without warranty of any kind, express or implied, including, but not limited to warranties of performance, merchantability and fitness for a particular purpose. Given the changing nature of laws, rules and regulations, there may be delays, omissions or inaccuracies in the information contained in this post. The information on this post is provided with the understanding that the Company is not herein engaged in rendering legal, accounting, tax, or other professional advice and services. As such, it should not be used as a substitute for consultation with professional accounting, tax, legal or other competent advisers. This post may contain views and opinions which are those of the authors and do not necessarily reflect the official policy or position of any other agency or organization. This post may also contain links to external websites that are not provided or maintained by or in any way affiliated with the Company and the Company does not guarantee the accuracy, relevance, timeliness, or completeness of any information on these external websites. Any/ all (Gold/ Personal/ Business) loan product specifications and information that maybe stated in this post are subject to change from time to time, readers are advised to reach out to the Company for current specifications of the said (Gold/ Personal/ Business) loan.