NIC Code - National Industrial Classification Code For Udyam registration

What is a NIC Code?

The NIC Code, National Industrial Classification, is a unique identification number assigned to various industries in India. It categorizes businesses based on the kind of activity they undertake. The Ministry of MSME (Micro, Small, and Medium Enterprises) of the Government of India assigns NIC Codes.

As mentioned, the NIC code serves as a standardized system for categorizing economic activities across various sectors. It provides a structured framework to classify businesses based on their primary economic activities, facilitating statistical analysis, policymaking, and industrial monitoring.

The acronym NIC code stands for National Industrial Classification, encompassing its purpose of organizing industries into distinct categories. Essentially, NIC codes offer a comprehensive taxonomy that enables government agencies, researchers, and businesses to accurately classify and analyse industrial data. With NIC code full form being National Industrial Classification, it plays a crucial role in describing the diverse landscape of economic activities. It helps in formulating strategies and regulations to support industrial development and growth.

NIC Code MSME

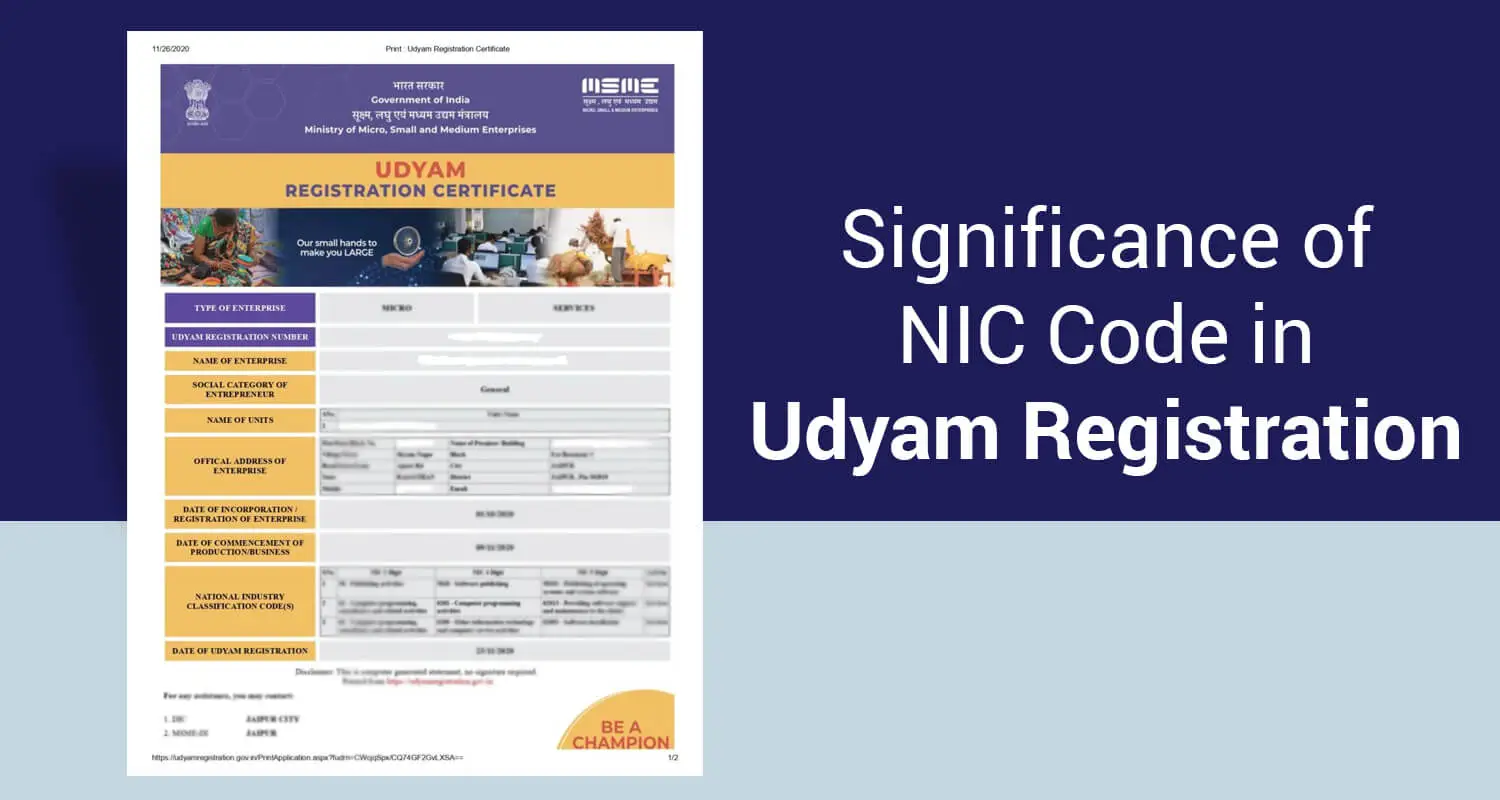

The NIC Code plays a vital role in MSME registration (Micro, Small, and Medium Enterprises). The MSME classification is based on investment in plant and machinery or equipment for the manufacturing and service sectors. A business must obtain a Udyam Registration to be considered an MSME and avail of the benefits associated with it.What is a NIC Code in Udyam Registration

The NIC Code is a mandatory requirement during Udyam registration, which is entirely online. While registering on the Udyam Registration portal, a business applicant needs to select the appropriate NIC code that best reflects their primary business activity.Sapna aapka. Business Loan Humara.

Apply NowSignificance of NIC Code in Udyam Registration

The NIC Code plays a critical role in MSME registration for several reasons. Here are some of the important points:

Classification of Business Activities: The NIC Code meaning signifies the classification of business activities into various categories. This classification is essential for the government to formulate and implement policies and programs specifically targeted to MSMEs operating in different sectors. For instance, the government might offer easier access to credit or loan schemes for MSMEs in specific industries.

Statistical Purposes: The NIC Code is used for statistical purposes to track the growth and development of MSMEs in various sectors. This data helps the government understand the industrial landscape and make informed decisions about MSME development initiatives.

Benefits and Subsidies: The NIC Code is a critical factor in determining the benefits and subsidies that an MSME is entitled to receive from the government. The government offers various benefits and subsidies to MSMEs, such as tax exemptions, concessional loans, and subsidies on electricity bills. The eligibility for these benefits and subsidies often depends on the NIC Code of the MSME.

MSME Database: The NIC Code is used to create a comprehensive database of MSMEs in India. This database helps the government to connect with MSMEs and provide them with relevant information and support services.

How to Find Your NIC Code

There are several ways to find the NIC Code for your business:

NIC Code Manual: You can refer to the NIC Code manual published by the Ministry of MSME. The manual provides a comprehensive list of NIC Codes for various industries.

Online Resources: The Ministry of MSME website also provides a searchable database of NIC Codes. You can search for the NIC Code that corresponds to your business activity.

Professional Help: You can consult with a professional, such as a chartered accountant or a tax advisor, to help you determine the correct NIC Code for your business.

List of NIC Code

| Division 01 |

Crop and animal production, hunting, and related service activities |

| Division 01 |

Crop and animal production, hunting, and related service activities |

| Group 011 |

Growing of non-perennial crops |

| Group 012 |

Growing perennial crops |

| Group 013 |

Plant propagation |

| Group 014 |

Animal production |

| Group 015 |

Mixed farming |

| Group 143 |

Manufacture of knitted and crocheted apparel |

| Division 15 |

Manufacture of leather and related products |

| Group 151 |

Tanning and dressing of leather; manufacture of luggage, handbags, saddlery and harness; dressing and dyeing of fur |

| Group 152 |

Manufacture of footwear |

| Division 16 |

Manufacture of wood and of products of wood and cork, except furniture; manufacture of articles of straw and plaiting materials |

| Group 161 |

Sawmilling and planning of wood |

| Group 162 |

Manufacture of products of wood, cork, straw, and plaiting materials |

| Division 17 |

Manufacture of paper and paper products |

| Group 170 |

Manufacture of paper and paper products |

| Division 18 |

Printing and reproduction of recorded media |

| Group 181 |

Printing and service activities related to printing |

| Group 182 |

Reproduction of recorded media |

| Division 19 |

Manufacture of coke and refined petroleum products |

| Group 191 |

Manufacture of coke oven products |

| Group 192 |

Manufacture of refined petroleum products |

| Division 20 |

Manufacture of chemicals and chemical products |

| Group 201 |

Manufacture of basic chemicals, fertilizer and nitrogen compounds, plastics, and synthetic rubber in primary forms |

| Group 202 |

Manufacture of other chemical products |

| Group 203 |

Manufacture of man-made fibers |

| Division 21 |

Manufacture of pharmaceuticals, medicinal chemicals and botanical products |

| Group 210 |

Manufacture of pharmaceuticals, medicinal chemicals and botanical products |

| Group 151 |

Tanning and dressing of leather; manufacture of luggage, handbags, saddlery, and harness; dressing and dyeing of fur |

| Group 152 |

Manufacture of footwear |

| Division 16 |

Manufacture of wood and products of wood and cork, except furniture; manufacture of articles of straw and plaiting materials |

| Group 161 |

Sawmilling and planing of wood |

| Division 22 |

Manufacture of rubber and plastics products |

| Group 221 |

Manufacture of rubber products |

| Group 222 |

Manufacture of plastics products |

| Division 23 |

Manufacture of other non-metallic mineral products |

| Group 231 |

Manufacture of glass and glass products |

| Group 239 |

Manufacture of non-metallic mineral products n.e.c. |

| Division 24 |

Manufacture of basic metals |

| Group 241 |

Manufacture of basic iron and steel |

| Group 242 |

Manufacture of basic precious and other non-ferrous metals |

| Group 243 |

Casting of metals |

| Division 25 |

Manufacture of fabricated metal products, except machinery and equipment |

| Group 251 |

Manufacture of structural metal products, tanks, reservoirs and steam generators |

| Group 252 |

Manufacture of weapons and ammunition |

| Group 259 |

Manufacture of other fabricated metal products; metalworking service activities |

| Group 105 |

Manufacture of dairy products |

| Group 106 |

Manufacture of grain mill products, starches, and starch products |

| Group 107 |

Manufacture of other food products |

| Group 108 |

Manufacture of prepared animal feeds |

| Division 11 |

Manufacture of beverages |

| Group 110 |

Manufacture of beverages |

| Division 26 |

Manufacture of computer, electronic, and optical products |

| Group 261 |

Manufacture of electronic components |

| Group 262 |

Manufacture of computers and peripheral equipment |

| Group 272 |

Manufacture of batteries and accumulators |

| Group 210 |

Manufacture of pharmaceuticals, medicinal chemicals and botanical products |

| Division 22 |

Manufacture of rubber and plastics products |

| Group 221 |

Manufacture of rubber products |

| Group 222 |

Manufacture of plastics products |

| Division 23 |

Manufacture of other non-metallic mineral products |

| Group 231 |

Manufacture of glass and glass products |

| Group 239 |

Manufacture of non-metallic mineral products n.e.c. |

| Division 24 |

Manufacture of basic metals |

| Group 241 |

Manufacture of basic iron and steel |

| Group 242 |

Manufacture of basic precious and other non-ferrous metals |

| Group 243 |

Casting of metals |

| Division 25 |

Manufacture of fabricated metal products, except machinery and equipment |

| Group 251 |

Manufacture of structural metal products, tanks, reservoirs, and steam generators |

| Group 252 |

Manufacture of weapons and ammunition |

| Group 259 |

Manufacture of other fabricated metal products; metalworking service activities |

| Division 26 |

Manufacture of computer, electronic, and optical products |

| Group 261 |

Manufacture of electronic components |

| Group 262 |

Manufacture of computers and peripheral equipment |

| Group 263 |

Manufacture of communication equipment |

| Group 264 |

Manufacture of consumer electronics |

| Group 265 |

Manufacture of measuring, testing, navigating, and control equipment; watches and clocks |

| Group 273 |

Manufacture of wiring and wiring devices |

| Group 274 |

Manufacture of electric lighting equipment |

| Group 275 |

Manufacture of domestic appliances |

| Group 279 |

Manufacture of other electrical equipment |

| Division 28 |

Manufacture of machinery and equipment n.e.c. |

| Group 281 |

Manufacture of general-purpose machinery |

| Group 282 |

Manufacture of special-purpose machinery |

| Division 29 |

Manufacture of motor vehicles, trailers and semi-trailers |

| Group 291 |

Manufacture of motor vehicles |

| Group 292 |

Manufacture of bodies (coachwork) for motor vehicles; manufacture of trailers and semi-trailers |

| Group 293 |

Manufacture of parts and accessories for motor vehicles |

| Division 30 |

Manufacture of other transport equipment |

| Group 301 |

Building of ships and boats |

| Group 302 |

Manufacture of railway locomotives and rolling stock |

| Group 303 |

Manufacture of air and spacecraft and related machinery |

| Group 304 |

Manufacture of military fighting vehicles |

| Group 309 |

Manufacture of transport equipment n.e.c. |

| Division 31 |

Manufacture of furniture |

| Group 310 |

Manufacture of furniture |

| Division 32 |

Other manufacturing |

| Group 321 |

Manufacture of jewellery, bijouterie, and related articles |

| Group 322 |

Manufacture of musical instruments |

| Group 323 |

Manufacture of sports goods |

| Group 324 |

Manufacture of games and toys |

| Group 325 |

Manufacture of medical and dental instruments and supplies |

| Group 329 |

Other manufacturing n.e.c. |

| Section I |

Accommodation and Food service activities |

| Division 55 |

Accommodation |

| Group 582 |

Software publishing |

| Division 59 |

Motion picture, video, and television program production, sound recording, and music publishing activities |

| Group 591 |

Motion picture, video, and television programme activities |

| Group 592 |

Sound recording and music publishing activities |

| Group 231 |

Manufacture of glass and glass products |

| Group 239 |

Manufacture of non-metallic mineral products n.e.c. |

| Division 24 |

Manufacture of basic metals |

| Group 241 |

Manufacture of basic iron and steel |

| Group 231 |

Manufacture of glass and glass products |

| Group 239 |

Manufacture of non-metallic mineral products n.e.c. |

| Division 24 |

Manufacture of basic metals |

| Group 241 |

Manufacture of basic iron and steel |

| Group 242 |

Manufacture of basic precious and other non-ferrous metals |

| Group 243 |

Casting of metals |

| Division 25 |

Manufacture of fabricated metal products, except machinery and equipment |

| Group 242 |

Manufacture of basic precious and other non-ferrous metals |

| Group 243 |

Casting of metals |

| Division 25 |

Manufacture of fabricated metal products, except machinery and equipment |

| Division 60 |

Broadcasting and programming activities |

| Group 981 |

Undifferentiated goods-producing activities of private households for their own use |

| Group 982 |

Undifferentiated service-producing activities of private households for their own use |

| SECTION U |

Activities Of Extraterritorial Organizations And Bodies |

| Division 99 |

Activities of extraterritorial organizations and bodies |

| Group 990 |

Activities of extraterritorial organizations and bodies |

Applications with NIC Code

NIC codes are essential for classifying businesses and economic activities in India. They serve several crucial purposes:

- NIC codes help the government understand different industries better, allowing for targeted policies and support programs.

- By categorizing businesses, NIC codes provide valuable data for economic research and planning.

- Accurately assigning an NIC code during business registration ensures compliance with regulations and eligibility for specific benefits.

- Consistent use of NIC codes improves the quality of statistical data, enabling better decision-making.

Examples of NIC Code Structure

Section C: Manufacturing (Broad sector)

Division 20: Manufacture of Motor Vehicles, Trailers, and Semi-trailers (Major group)

Group 291: Manufacture of Motor Vehicles (Specific industry group)

Class 2910: Manufacture of Motor Vehicles (Individual class)

Subclass 29101: Manufacture of Motor Vehicles (Specific activity)

Conclusion

The NIC Code is an essential component of MSME registration in India. It plays a significant role in classifying businesses, tracking their growth, and determining their eligibility for government benefits and subsidies. By understanding the importance of the NIC Code and selecting the appropriate code during Udyam registration, businesses can ensure they are classified correctly and can avail the benefits they are entitled to.Additional Considerations

The NIC Code system is regularly updated by the Ministry of MSME. It's important to stay updated on any changes to the NIC Code system.

If you are unsure about the correct NIC Code for your business, it is always best to consult with a professional advisor.

FAQs

Q1. What is the difference between NIC Code and HS Code?Ans. NIC Code and HS Code (Harmonized System Code) are two different classification systems. NIC Code classifies businesses based on their activity, while HS Code classifies goods for customs purposes.

Q2. Can I have multiple NIC Codes for my business?Ans. Generally, a business should have one primary NIC Code that reflects its main activity. However, there may be situations where a business has multiple activities. In such cases, you can consult with a professional advisor to determine if you need to register for additional NIC Codes.

Q3. What happens if I choose the wrong NIC Code?Ans. Choosing the wrong NIC Code might lead to delays in processing your Udyam registration or ineligibility for certain benefits. If you are unsure about the correct code, it's best to consult with a professional before registering.

Q4. Where can I find updates on the NIC Code system?Ans. You can check the Ministry of MSME website for NIC Code system updates.

Sapna aapka. Business Loan Humara.

Apply NowDisclaimer: The information contained in this post is for general information purposes only. IIFL Finance Limited (including its associates and affiliates) ("the Company") assumes no liability or responsibility for any errors or omissions in the contents of this post and under no circumstances shall the Company be liable for any damage, loss, injury or disappointment etc. suffered by any reader. All information in this post is provided "as is", with no guarantee of completeness, accuracy, timeliness or of the results etc. obtained from the use of this information, and without warranty of any kind, express or implied, including, but not limited to warranties of performance, merchantability and fitness for a particular purpose. Given the changing nature of laws, rules and regulations, there may be delays, omissions or inaccuracies in the information contained in this post. The information on this post is provided with the understanding that the Company is not herein engaged in rendering legal, accounting, tax, or other professional advice and services. As such, it should not be used as a substitute for consultation with professional accounting, tax, legal or other competent advisers. This post may contain views and opinions which are those of the authors and do not necessarily reflect the official policy or position of any other agency or organization. This post may also contain links to external websites that are not provided or maintained by or in any way affiliated with the Company and the Company does not guarantee the accuracy, relevance, timeliness, or completeness of any information on these external websites. Any/ all (Gold/ Personal/ Business) loan product specifications and information that maybe stated in this post are subject to change from time to time, readers are advised to reach out to the Company for current specifications of the said (Gold/ Personal/ Business) loan.