What Is The 50/30/20 Rule Of Budgeting?

With steady rise in inflation and cost of living, it is very important to budget one’s income so as not to overspend in unnecessary expenses. Applying a budgeting rule on one’s monthly earnings, help manage finances and plan for savings and investments. 50/30/20 rule is one such budgeting rule. 50/30/20 is a percentage based budgeting rule which was initially popularised by Senator Elizabeth Warren in her book “All your worth: Ultimate lifetime money plan”.

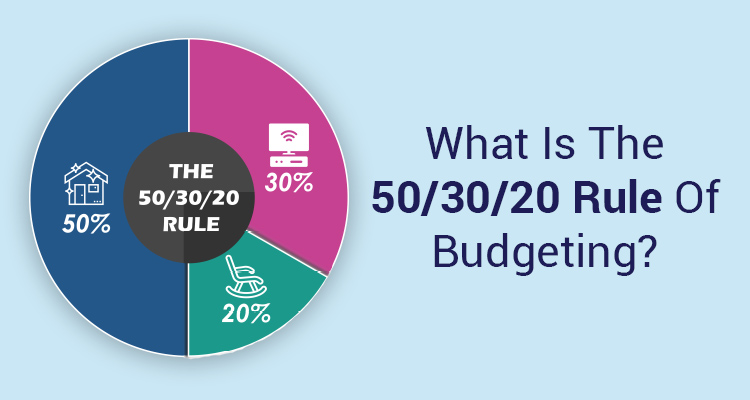

What does the 50/30/20 rule mean?

The 50/30/20 rule states that the monthly after tax income of an individual should be divided into three components. 50% for needs, 30% for wants and 20% for savings. With this categorization, it will be easier for the individual to keep a track on the expenditures and reduce superfluous ones. The purpose of this rule is to balance the expenditures and be mindful of savings and investments. It also helps save money for medical emergencies and retirement.

50/30/20 Categorizations

Needs: 50%

50% of the after-tax income should help cater to needs which are the expenses that are essential for your survival. Hence, they cannot be delayed at any cost. Needs might include expenses like house rent, food and groceries, EMIs, payments of credit card bills and other utility bills, insurance premiums etc. If any such payment is delayed or missed then it might land you in trouble or increase the financial burden due to late payment fees. Late or delayed payment of credit cards and EMIs also hamper your credit score.

If you spend more than 50% on your needs, then you will have to either cut down on your wants or downsize your lifestyle. One should be able to identify between need and want. Luxuries like TV cable subscriptions or Netflix, new IPhone etc. can be considered as want. You should refrain yourself from such expenses until they have been planned.

Wants: 30%

Wants constitutes a list of items that are not essential for your survival but you aspire to acquire. This is the trickiest section and needs most discipline. If unregulated, you might end up spending your savings to fulfil your wants. It is essential to cap the spending on your wants at a point. You can start setting aside some amount as a separate, smaller fund exclusively dedicated to an expensive purchase. This will also help you avoid taking small loans or no-cost EMI traps. To curb your wants, you can also avoid going on retail therapy and avoid any unnecessary purchases.

Savings: 20%

Needs and wants cater to present demands of an individual while savings will help cater to future demands. It will help take care of post retirement expenses and any unforeseen emergency related to health or job loss. You should invest in avenues that beat inflation and allow easy withdrawals without much paperwork and withdrawal charges.

You could also save and invest for your long-term goals. You can invest in aggressive growth funds like small-cap, multi-cap funds, SIP etc. You can also start creating an emergency fund which should ideally be large enough to cater to your three to six months expenses plus the amount used up in your last emergency.

Get Gold Loan at the comfort of your home

Apply NowBenefits of 50/30/20 rule

- Simple to comprehend and apply – It is a simple framework for budgeting and can be applied immediately without complex calculations.

- Financial balance – It helps strike a financial balance amongst your expenses and savings and investments. It prevents you to go over budget on your spending.

- Prioritize expenses – As this budgeting requires you to spend 50% on your needs, you tend to plan out your expenses.

- Helps meet long term goals – By saving 20% of your post tax income, you can create a corpus to meet your long term goals, post retirement expenses etc.

How to adopt 50/30/20 rule?

Here are some ways that might help you follow 50/30/20 rule.

- Keep a record and analyse your expenses for a month or two. This will help you understand and classify your expanses under the three categories and set the groundwork for the adoption of the rule.

- Evaluate your after-tax income and try to allocate the correct budget amounts for the three categories.

- Identify your needs and wants.

- Allocate funds and identify the instruments for your savings and investments.

- Maintain consistency by following this rule every month.

Conclusion

While there is no one way to manage your money but 50/30/20 rule helps inculcate a healthy habit to manage money efficiently. It ensures that you spend your money diligently and have a greater control over the inflows and outflows of money. It helps you direct funds for emergency expenses and retirement.

Frequently Asked Questions

1. Can I modify the percentages in 50/30/20 rule?

Yes, you may modify the percentages depending upon your circumstances and priorities.

2. Should I include taxes in the calculation of amounts under three categories?

Ideally, you should not consider taxes for the calculation.

Sapna aapka. Business Loan Humara.

Apply NowDisclaimer: The information contained in this post is for general information purposes only. IIFL Finance Limited (including its associates and affiliates) ("the Company") assumes no liability or responsibility for any errors or omissions in the contents of this post and under no circumstances shall the Company be liable for any damage, loss, injury or disappointment etc. suffered by any reader. All information in this post is provided "as is", with no guarantee of completeness, accuracy, timeliness or of the results etc. obtained from the use of this information, and without warranty of any kind, express or implied, including, but not limited to warranties of performance, merchantability and fitness for a particular purpose. Given the changing nature of laws, rules and regulations, there may be delays, omissions or inaccuracies in the information contained in this post. The information on this post is provided with the understanding that the Company is not herein engaged in rendering legal, accounting, tax, or other professional advice and services. As such, it should not be used as a substitute for consultation with professional accounting, tax, legal or other competent advisers. This post may contain views and opinions which are those of the authors and do not necessarily reflect the official policy or position of any other agency or organization. This post may also contain links to external websites that are not provided or maintained by or in any way affiliated with the Company and the Company does not guarantee the accuracy, relevance, timeliness, or completeness of any information on these external websites. Any/ all (Gold/ Personal/ Business) loan product specifications and information that maybe stated in this post are subject to change from time to time, readers are advised to reach out to the Company for current specifications of the said (Gold/ Personal/ Business) loan.