Understanding Financial Swaps: Meaning, Features & Types

Financial swaps are essential derivatives in modern finance that help institutions manage risk, hedge against uncertainties, or optimize their financial positions. In this blog, we’ll look at what financial swaps are, their key features, characteristics, and how interest rate swaps work, including real-world examples.

Introduction to Swaps

Swaps are financial contracts where two parties agree to exchange one type of cash flow for another over a certain period. They are typically traded over-the-counter (OTC) rather than on exchanges, meaning they are negotiated directly between the involved parties. The flexibility of swaps allows for a broad range of financial applications, including risk management and speculative activities. The most common type of swap is the interest rate swap, but other types include currency, commodity, and credit default swaps.

What is a Financial Swap?

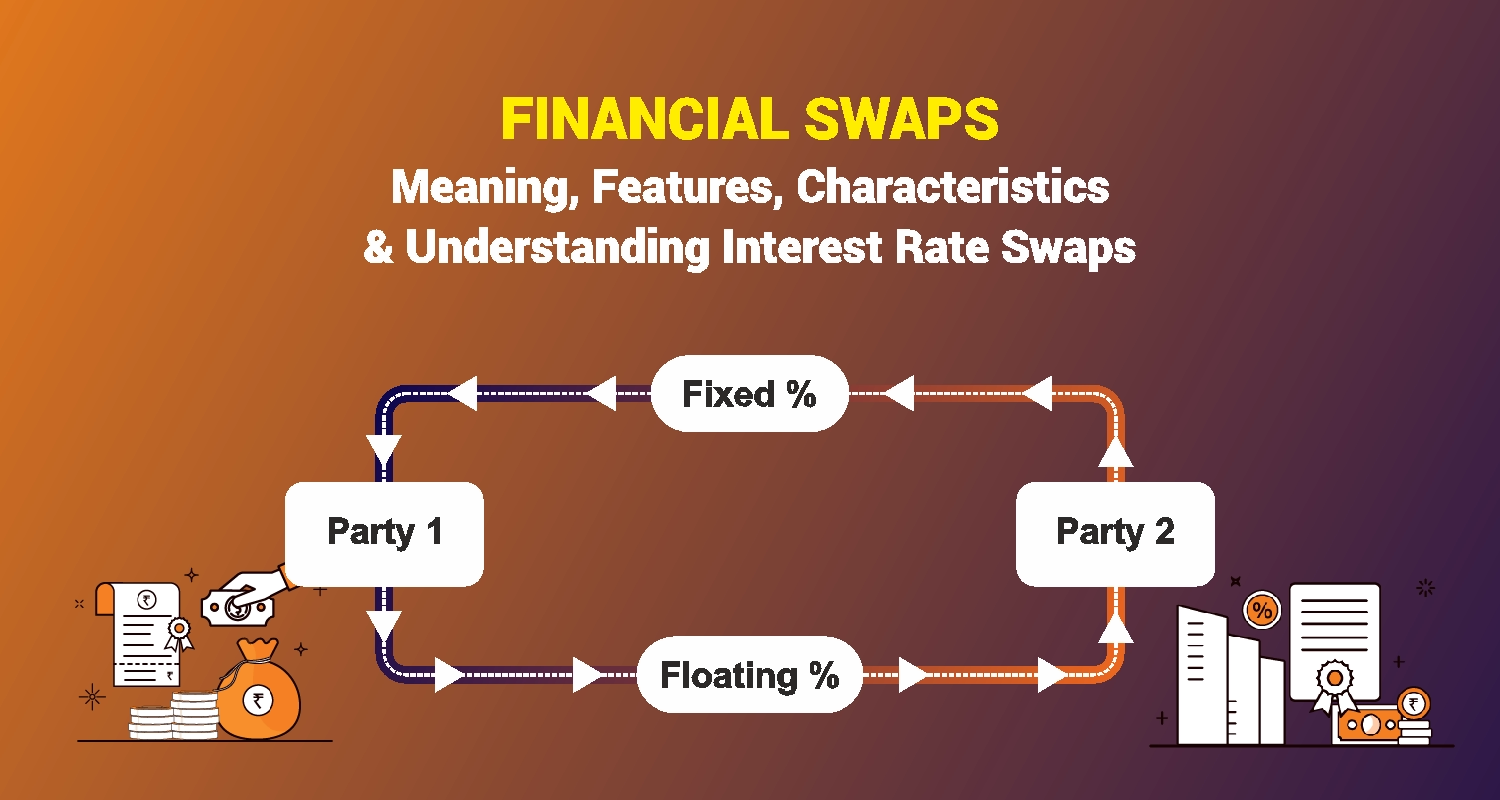

A financial swap refers to a derivative contract where two counterparties exchange the cash flows of two financial instruments based on a predetermined notional principal. Each stream of cash flows is called a "leg." For example, one party might agree to pay a fixed interest rate on a loan, while the other party agrees to pay a floating interest rate based on an index.

Swaps have grown in popularity due to their flexibility and ability to serve various financial goals, such as hedging against currency or interest rate fluctuations, optimizing debt structures, or even speculating on market conditions.

Types of Swaps

The different types of swaps are:

Interest Rate Swap: Involves the exchange of interest rate payments (fixed for floating or vice versa) on a specified notional principal.

Currency Swap: Entities exchange principal and interest payments in different currencies to hedge against currency exchange risks.

Commodity Swap: The exchange of cash flows depending on the commodity's (like gold or oil) price.

Credit Default Swap (CDS): A swap where one party pays a premium in exchange for protection against the default of a third-party’s debt.

Sapna aapka. Business Loan Humara.

Apply NowKey Features of Swaps

The features of financial swaps include:

- Customizable: Swaps can be highly customized based on the specific needs of the parties involved. Unlike standardized exchange-traded derivatives like futures and options, swaps can include unique terms, conditions, and payment structures.

- Over-the-Counter (OTC): Swaps are typically traded over-the-counter, meaning they are privately negotiated contracts between parties rather than traded on centralized exchanges.

- Notional Principal: No principal is exchanged upfront in most swaps. Instead, the cash flows are calculated based on an agreed-upon notional principal amount.

- Risk Management: One key use of swaps is to manage financial risk, especially interest rate or currency exchange rate risks.

- Hedging and Speculation: While swaps are primarily used for hedging, they can also be used to speculate on market movements. Uncover the major differences between business risk and financial risk.

Characteristics of Financial Swaps

Cash Flow Exchanges: The core of any swap is the exchange of cash flows between the counterparties. The type of cash flows exchanged depends on the type of swap.

Counterparty Risk: Since swaps are OTC contracts, there is always the risk that one party may default on its obligation. This counterparty risk is a critical consideration in swap agreements.

Duration: Swap contracts have a specified duration, often ranging from a few years to over a decade.

No Physical Exchange of Assets: Unlike commodity futures where the actual product is delivered, swaps typically involve only cash flow exchanges based on the notional value, not the transfer of the underlying asset.

Payment Frequency: Swaps usually involve periodic payments (monthly, quarterly, or yearly), depending on the contract's terms.

The Most Common Swap Type: Interest Rate Swaps

The most widely used type of swap is an interest rate swap. It involves two parties agreeing to exchange interest payments on a notional principal amount. Typically, one party pays a fixed interest rate, while the other pays a floating interest rate based on an index (e.g., LIBOR or SOFR). These swaps help companies manage exposure to fluctuating interest rates or lock in fixed-rate payments to reduce risk.

Features of Interest Rate Swaps

Fixed-for-Floating: In most interest rate swaps, one party pays a fixed rate, and the other party pays a floating rate. This arrangement is particularly useful when a company wants to lock in predictable cash flows or when it expects future interest rate fluctuations.

Notional Principal: No exchange of the actual principal takes place. The swap’s interest payments are based on a notional principal amount, which is simply a reference figure.

Hedging Tool: Interest rate swaps are often used by companies to manage the risks associated with variable interest rate loans or investments.

Example of an Interest Rate Swap

Here's an example of an interest rate swap in India's context:

Let's assume Company A (an Indian conglomerate) has a ₹50 crore (500 million) loan with a floating interest rate based on MCLR (Marginal Cost of Lending Rate) + 2%, while Company B (an Indian manufacturing firm) has a loan with a fixed interest rate of 8%. Both companies want to swap their interest rate obligations because Company A prefers fixed-rate payments to avoid rising rates, and Company B expects interest rates to fall and prefers floating-rate payments.

- Company A: Agrees to pay a fixed rate of 8% to Company B.

- Company B: Agrees to pay Company A MCLR + 2% on the notional principal of ₹50 crore.

At each payment period (e.g., quarterly), the two companies will calculate the interest due based on their respective rates, and the net difference is exchanged.

For example:

- If MCLR is at 5%, Company B would owe 7% (5% + 2%) in interest payments to Company A, while Company A owes a fixed 8% interest to Company B.

- If interest rates rise to 6%, Company B would owe 8% (6% + 2%), which matches the fixed rate Company A pays.

Through the swap, both companies achieve their desired interest rate structure without changing the terms of their original loans.

Importance and Usage of Swaps

Risk Management: Swaps, particularly interest rate and currency swaps, are employed by companies to hedge against market fluctuations. For instance, a company exposed to fluctuating interest rates on its debt can use a swap to convert the debt into fixed-rate payments, reducing exposure to rate increases.

Speculation: While swaps are primarily a risk management tool, some entities use them to speculate on future changes in interest rates, commodity prices, or currency values.

Access to New Markets: Currency swaps can allow businesses to access financing in foreign currencies, reduce borrowing costs, or enter new markets by converting their financial obligations into another currency. Additionally, understanding financial leverage allows businesses to maximize their return on investment by using borrowed capital to increase the potential return from their investments.

Conclusion

Financial swaps, especially interest rate swaps, are powerful tools that allow businesses and financial institutions to manage risks, hedge against unfavorable market conditions, and even speculate. These customizable contracts can be tailored to meet the specific needs of the parties involved, making them a versatile option in modern finance. Understanding the features and characteristics of swaps can help organizations make more informed decisions when navigating volatile financial markets.

FAQs

Q1. What is a financial swap?

Ans. A swap is a financial contract where two entities exchange cash flows on the basis of a notional principal.

Q2. What are the features of swaps?

Ans. Swaps are customizable, OTC traded, involve periodic payments, and help manage financial risk.

Q3. What is an interest rate swap?

Ans. It is a swap where two parties exchange interest payments—typically one fixed and one floating—based on a notional principal.

Q4. How are swaps used?

Ans. Swaps are primarily used for risk management, hedging, and sometimes speculation.

Q5. Can you give an example of an interest rate swap?

Ans. Company A pays a fixed interest rate, while Company B pays a floating rate, allowing both to manage their exposure to interest rate changes.

Sapna aapka. Business Loan Humara.

Apply NowDisclaimer : The information in this blog is for general purposes only and may change without notice. It does not constitute legal, tax, or financial advice. Readers should seek professional guidance and make decisions at their own discretion. IIFL Finance is not liable for any reliance on this content. Read more