Taxation Tips for Small Businesses & MSMEs

Financial health of Micro, Small and Medium Enterprises (MSMEs) in India is dependent on the role that taxation plays. About 30 percent of the GDP and millions of employees, these businesses are the backbone of the economy. Managing taxes efficiently can be challenging, but understanding the available tax benefits to small scale industries is essential for saving money and ensuring sustainable growth.

MSMEs often operate on tight margins, so taking full advantage of tax reliefs can make a significant difference. Proper tax planning helps avoid unnecessary penalties and ensures compliance with legal obligations. The various MSME tax benefits can be known and used to optimize tax savings. In this article, we will discuss various taxes, key benefits, practical tips and government initiatives which help MSMEs in tax management.

5 Useful Tips for MSMEs to Save Tax

- Keep detailed and accurate financial records for tax benefits.

- Utilize all eligible deductions to reduce tax liability.

- Reduce GST burden by claiming Input Tax Credit.

- Invest wisely in government bonds to defer or avoid taxes.

- Leverage Government Schemes for optimum tax benefits.

By planning your tax, you can save a lot of money on taxes and use it in expanding and growing your business. If you want to understand exactly what taxes MSMEs have to pay and which tax saving strategies to adopt, keep reading.

Types of Taxes Applicable to MSMEs

Understanding the types of taxes MSMEs need to pay is the first step in leveraging tax benefits to small scale industries. MSMEs in India face two main categories of taxes: direct and indirect.

Direct Taxes:

- Income Tax: Income tax is based on profits for MSMEs. However, companies with an annual turnover of up to ₹400 crore are taxed at a concessional rate of 25%. Rather, this lower rate is meant to lighten the financial burden on small businesses.

- Presumptive Taxation: MSMEs with turnover of less than ₹2 crore can also opt for presumptive taxation under Section 44AD, where tax is paid on estimated profits at 8 per cent of turnover. It streamlines compliance, and cuts down on paperwork.

Indirect Taxes:

- Goods and Services Tax (GST): MSMEs must register for GST if their turnover exceeds ₹40 lakh (₹20 lakh for special category states). While GST compliance can seem complex, the government offers lower rates for many products and services produced by MSMEs.

Several exemptions and reduced rates fall under tax benefits to small scale industries, helping businesses manage costs. For example, GST rates for handicrafts and textiles are as low as 5%, which takes a load off the small manufacturers.

Knowing these obligations means MSMEs can plan their finances well and not get penalized. Proper understanding and application of msme tax benefits provide a competitive edge in managing operations.

Tax Saving Tips for MSMEs:

Maximizing tax benefits to small scale industries requires careful planning and strategic execution. Here are some practical tips to help MSMEs optimize their tax savings:

- Maintain Accurate Records: Keeping detailed and accurate records of all transactions is essential. Proper bookkeeping helps in identifying all deductible expenses and ensures compliance during audits.

- Leverage Deductions Fully: Utilize all available deductions, such as those under Sections 80C, 80D, and 80JJA. For example, deductions for employee salaries and capital investments can significantly reduce taxable income.

- Claim Input Tax Credits (ITC): MSMEs registered under GST can claim ITC on goods and services used in their business. This reduces the net GST payable, saving money.

- Invest in Government Bonds: Reinvesting capital gains into specified government bonds can help MSMEs defer or avoid taxes. This is a strategic way to utilize maximum tax benefits for msmes for long-term savings.

- Utilize Government Schemes: Programs like Startup India and Make in India offer various tax incentives. Staying informed about these schemes ensures MSMEs don’t miss out on valuable tax reliefs.

Example Tip:

If an MSME spends ₹10 lakh on new machinery. As per Section 35AD, they can take 100 per cent of this investment as deduction thus reducing their taxable income by ₹10 lakh. It immediately reduces their tax liability and stimulates reinvestment.

These strategies are quite helpful for MSMEs to save money and keep them in compliance, making the most of their available tax benefits to small scale industries.

Quick & easy loans for your business growth

Apply NowKey Tax Benefits for Small Scale Industries

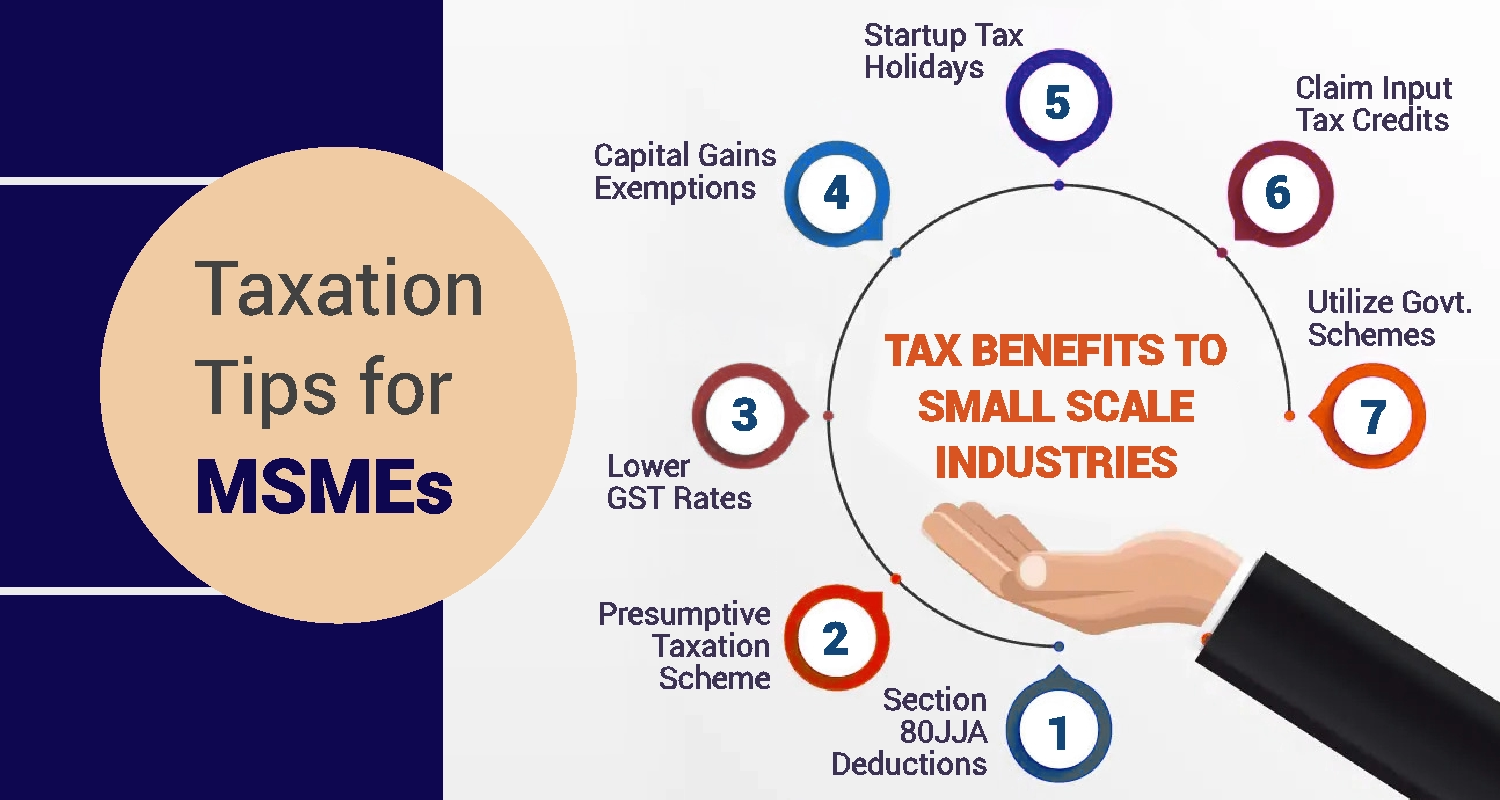

MSMEs in India enjoy a range of msme tax benefits designed to promote growth and financial stability. Here are some key advantages:

- Section 80JJA Deductions: MSMEs that hire new employees can claim deductions on additional wages paid. For each new employee, 30% of their salary can be deducted for three consecutive years. This not only reduces taxable income but also encourages employment.

- Presumptive Taxation Scheme: We have already mentioned that MSMEs with a turnover up to ₹2 crore can pay tax based on presumed profits. This scheme reduces compliance burden and simplifies tax calculation. For instance, if a business generates ₹1.5 crore per annum, it pays taxes on only 8 per cent of its turnover and thus has dramatically lower tax liability.

- Lower GST Rates: Essential goods and services often produced by MSMEs benefit from reduced GST rates. For instance, many agricultural products, textiles, and handicrafts fall under the 5% slab. This reduction makes MSME products more competitive in the market.

- Capital Gains Exemptions: MSMEs can reinvest capital gains from selling assets into specific government bonds to avoid taxes. This is a significant saving strategy under tax benefits to small scale industries.

- Startup Tax Holidays: Tax holidays can be enjoyed by startups registered under Startup India initiative, subject to conditions, for the first three years of their operations. They’re able to reinvest profits into business growth.

Example Scenario:

Suppose there is an MSME with 1.8 crore turnover and 10% profit. Without presumptive taxation, they would be liable to pay ₹18 lakh tax. With a presumptive scheme, they may have to pay tax on Rs 14.4 lakh (8 per cent of turnover), and save around Rs 1 lakh annually.

These tax benefits for small scale industries promote business owners to manage their finances in such a manner that enables the business to grow sustainably.

How to Claim MSME Tax Benefits:

Claiming tax benefits for memes involves a structured process:

- Organize Documentation: Ensure all necessary documents, such as invoices, salary records, and investment proofs, are in order. Accurate documentation is key to claiming deductions.

- Know Key Deadlines:

- Income Tax Returns (ITR) must be filed by July 31st each year (dates may extend in certain situations).

- GST returns are filed monthly or quarterly, depending on turnover. Late filings can attract penalties.

- Use Online Portals: The government’s e-filing portal for income tax and GST portal for GST returns make the process simpler. Familiarize yourself with these platforms to file returns efficiently.

- Seek Professional Assistance: Tax consultants or chartered accountants can help ensure all available tax benefits for msmes are utilized and that filings are accurate.

Common Mistakes to Avoid:

- Fines will be imposed if deadlines are missed.

- Disputes or audits can be caused by incorrect data entry.

- Lack of deductions can reduce potential savings.

If MSMEs follow these steps, they will realize that they are taking full advantage of available tax incentives, which will, in turn, help improve their financial stability.

Government Initiatives and Support for MSME Taxation:

The Indian government offers several initiatives to support MSMEs:

- Startup India: Offers tax exemptions for the first three years of operation to help new businesses invest their profits again.

- Make in India: Tax incentives encourage domestic manufacturing and promote local businesses.

These are also in the category of broader tax benefits to small scale industries, which relieves financial burden and also fosters growth. Access to valuable resources and savings is available for MSMEs by participating.

Conclusion

MSMEs need to understand the tax benefits to small scale industries for running their business in a competitive market. Businesses can use msme tax benefits to reduce tax burdens, save money and invest them back in growth by staying informed. With long term success and financial stability, proper planning is important.

FAQs for Taxation Tips for MSMEs:

Q1. What are the most important tax benefits to small scale industries in India?

Ans. The schemes which are beneficial for small scale industries in India are Presumptive Taxation Scheme U/s 44AD, Deductions for Employment of New Employees U/s 80JJA. Under such provisions, the taxes benefits to small scale industries will decrease their taxability as well as enhance compliance, resulting in better profitability and strong business growth.

Q2. How can MSMEs utilize msme tax benefits effectively?

Ans. To maximize the tax benefits for msme, MSMEs should maintain accurate records, claim all eligible deductions, and leverage input tax credits under GST. Proper use of government schemes like Startup India also provides additional tax savings. These steps ensure businesses capitalize on available incentives, reducing tax liabilities significantly.

Q3. What documents are needed to claim tax benefits to small scale industries?

Ans. To claim tax benefits to small scale industries, MSMEs need documents such as income and expense statements, investment proofs, employee salary records, and GST invoices. Proper documentation ensures smooth tax filing and maximizes eligible deductions, making it easier to comply with tax regulations and benefit from available incentives.

Q4. Are there any government initiatives that provide msme tax benefits?

Ans. Yes, government schemes like Startup India and Make in India do provide msme tax benefits such as tax holidays, lower GST rates, and exemption on capital gain. These programs aim to support small businesses by reducing their tax burden, fostering innovation, and encouraging entrepreneurship in India.

Quick & easy loans for your business growth

Apply NowDisclaimer: The information contained in this post is for general information purposes only. IIFL Finance Limited (including its associates and affiliates) ("the Company") assumes no liability or responsibility for any errors or omissions in the contents of this post and under no circumstances shall the Company be liable for any damage, loss, injury or disappointment etc. suffered by any reader. All information in this post is provided "as is", with no guarantee of completeness, accuracy, timeliness or of the results etc. obtained from the use of this information, and without warranty of any kind, express or implied, including, but not limited to warranties of performance, merchantability and fitness for a particular purpose. Given the changing nature of laws, rules and regulations, there may be delays, omissions or inaccuracies in the information contained in this post. The information on this post is provided with the understanding that the Company is not herein engaged in rendering legal, accounting, tax, or other professional advice and services. As such, it should not be used as a substitute for consultation with professional accounting, tax, legal or other competent advisers. This post may contain views and opinions which are those of the authors and do not necessarily reflect the official policy or position of any other agency or organization. This post may also contain links to external websites that are not provided or maintained by or in any way affiliated with the Company and the Company does not guarantee the accuracy, relevance, timeliness, or completeness of any information on these external websites. Any/ all (Gold/ Personal/ Business) loan product specifications and information that maybe stated in this post are subject to change from time to time, readers are advised to reach out to the Company for current specifications of the said (Gold/ Personal/ Business) loan.