Working Capital Loans for MSME - Importance, Benefits & Types

Running an MSME (Micro, Small and Medium Enterprises) presents unique challenges. Every business, including MSMEs requires a smooth flow of funds to operate efficiently. This essential element is called working capital. Working capital refers to the cash needed to cover everyday expenses, such as purchasing raw materials, paying salaries, managing inventory, and meeting operational costs. Without sufficient working capital, daily operations can come to a halt.

This is where MSME working capital loans come to the rescue. These specially designed loans provide a much-needed financial boost to help MSMEs maintain smooth cash flow and perform their daily operations. In the following sections, we'll explore the concept of working capital in detail and explore the various MSME working capital loan options available to Indian businesses.

What is Working Capital for an MSME?

Understanding the Basics

The foundation of any firm, particularly MSMEs, is its working capital. It refers to the difference between a company's current assets (like inventory, cash, and accounts receivable) and its current liabilities (like accounts payable and short-term debt).

A Simple Example

Imagine you run a small bakery. Ingredients like flour, sugar, and eggs are needed to make cakes. These are your current assets, often known as working capital. To purchase these ingredients, you might need to pay your suppliers upfront. This is a current liability. Your working capital is the difference between your current assets and current liabilities.

The Working Capital Cycle:

The working capital cycle is a continuous process where cash is used to purchase inventory, which is then sold to generate revenue. The cycle is repeated when suppliers and employees are paid with this revenue.

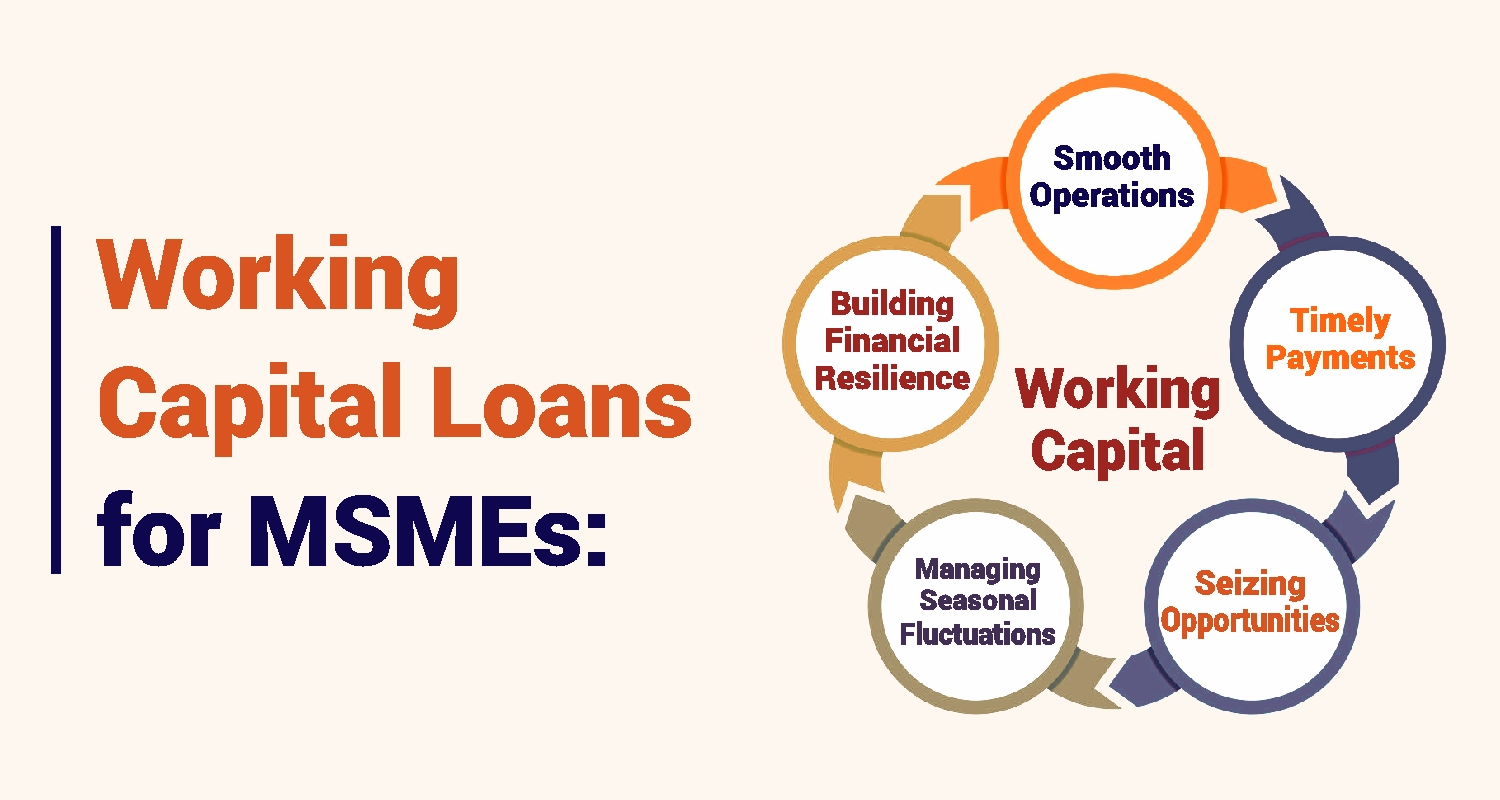

Why is Working Capital Important?

- Smooth Operations: Sufficient working capital ensures that day-to-day operations run smoothly, without disruptions.

- Meeting Financial Obligations: It helps businesses meet their financial obligations on time, such as paying salaries, rent, and taxes.

- Taking Advantage of Opportunities: Adequate working capital allows businesses to seize opportunities, like bulk purchases or new product launches.

- Building a Strong Financial Foundation: A healthy working capital position can improve a business's creditworthiness and attract potential investors.

By understanding the concept of working capital, MSMEs can better manage their finances and ensure their long-term sustainability.

Why is Working Capital Important for MSMEs?

Working capital is one of the most important factors for the survival and growth of MSMEs. Here's why:

- Smooth Operations: Working capital is sufficient to allow businesses to cover day to day business operational expenses such as buying raw materials, paying salaries, paying rent and so on.

- Timely Payments: A good working capital helps businesses to pay suppliers and creditors on time so that it can keep good relations with them and avoid penalties.

- Seizing Opportunities: A good working capital position means a business can take advantage of opportunities like bulk purchases, going into new markets or developing new products.

- Managing Seasonal Fluctuations: Working capital can be used by businesses with seasonal sales cycles to manage cash flow fluctuations and achieve smooth operations during the off peak period.

- Building Financial Resilience: This position of strong working capital can help businesses to see out the economic downturns, marketplace swings, and unexpected problems.

Sadly, a great number of MSMEs in India do not have access to working capital. A recent Reserve Bank of India (RBI) study shows that access to finance, especially working capital, continues to be a major impediment for MSMEs. As a result, payments can be delayed, productivity can be reduced, and business can be closed.

By understanding the importance of working capital and taking steps to manage it effectively, MSMEs can improve their financial health and long-term sustainability.

Quick & easy loans for your business growth

Apply NowTypes of MSME Working Capital Loans Available:

There are several types of working capital loan for MSMEs in India. Here are some of the most common:

1. Term Loans:

- Purpose: While primarily used for long-term investments, term loans can also be used for working capital needs.

- Repayment: Repaid in fixed installments over a specific tenure.

- Benefits: Fixed interest rates and a clear repayment schedule.

2. Overdraft Facility:

- Purpose: Provides the flexibility to withdraw funds as needed, up to a certain pre-approved limit.

- Repayment: Repaid on demand or as per the agreed terms.

- Benefits: Quick access to funds and interest is charged only on the utilized amount.

3. Cash Credit:

- Goal: It enables companies to take out money up to a pre-approved limit, just like an overdraft facility.

- Repayment: Repaid on demand or as per the agreed terms.

- Benefits: Flexibility in repayment and can be very useful for various working capital requirements.

4. Invoice Discounting:

- Purpose: The goal is to provide instant cash flow by reducing client invoicing.

- Repayment: Made once the invoice is paid by the client.

- Repayment: Repaid once the customer pays the invoice.

- Benefits: Accelerates cash flow and reduces the wait period for payments.

5. Government-Sponsored Schemes:

- MUDRA Loans: These loans are offered by banks and non-banking financial companies (NBFCs) to micro, small, and medium enterprises.

- CGTMSE Scheme: This scheme provides credit guarantee cover to banks and other financial institutions for loans extended to MSMEs.

When you choose an MSME working capital loan, it’s advisable to consider interest rate, repayment tenure, processing fee and reputation of the lender. We advise comparing offers from different lenders and choosing that which best meets your small business needs.

Benefits of MSME Working Capital Loans:

MSME working capital loans offer a range of benefits that can really impact the growth and success of your business:

- Improved Cash Flow: Working capital loan for MSME can make you access funds immediately and thus, manage your cash flow effectively. This guarantees you don’t miss paying salaries, rent and supplier bills on time.

- Enhanced Operational Efficiency: With sufficient working capital, you can optimize your operations, streamline processes, and improve productivity. This might end up saving cost and improve efficiency.

- Seizing Business Opportunities: Working capital loan for MSME can help you capitalize on unexpected opportunities, such as bulk orders or new business ventures. You can invest in inventory, expand your operations, or acquire new assets.

- Building Strong Supplier Relationships: Payment punctually to your suppliers can be beneficial for your small business relationship and enhance your negotiating power.

- Reduced Reliance on Debt: Effective working capital management can help you to reduce your dependence on debt financing and therefore lower your overall cost of capital.

MSME loan for working capital can be really beneficial to your small business and help it gain growth and maintain good financial health.

Application process for MSME Working Capital Loan:

Applying for an MSME working capital loan involves few key steps shared below:

- Prepare Necessary Documents:

- Gather the essential documents like your business registration certificate, PAN card, GSTIN and financial statements.

- Write a detailed business plan that includes what your business will do, what you hope to achieve, and how you will use that loan.

- Approach a Lender:

- Banks and Financial Institutions: A working capital loan for MSMEs is available from public and private sector banks as well as NBFCs.

- Government Schemes: Take a look at government sponsored schemes like MUDRA Yojana, which provide concessional loans to MSMEs.

- Submit Your Application:

- The lender will provide you with the loan application form and you will need to fill out the loan application form with accurate information about your business and financial details.

- Send in the accurately filled application form and needed paperwork.

- There are lenders that might ask for additional documents or want to visit your business site.

- Loan Approval Process:

- Lenders will assess your application on a number of factors, including your repayment ability, business performance, and creditworthiness.

- Your lender will have a credit check and verify the information you supply in your application.

- Once approved, the loan money will sit in your bank account.

Tips for a Successful Application:

- Maintain Good Financial Records: Accurate and up-to-date financial records can strengthen your loan application.

- Build a Strong Credit History: A good credit score can improve your chances of loan approval and lower interest rates.

- Choose the Right Lender: Research different lenders and compare their terms and conditions to find the best deal.

- Be Prepared for Documentation: Have all necessary documents ready to avoid delays in the loan approval process.

By following these steps and carefully considering your options, you can increase your chances of securing a working capital loan for MSMEs that will help your business thrive.

Conclusion

MSME working capital loan is important for every MSME. Knowing about the significance of working capital and the different loans you have are available will help you keep your business running smoothly.

The MSMEs can avail working capital loans under different government schemes and financial institutions that cater to the different requirements of MSMEs. If you carefully analyze your business requirements and pick the right loan, you can manage cash flow, maximize opportunities and grow your business.

FAQs about Working Capital Loans for MSMEs:

Q1. What is a working capital loan?

Ans. A working capital loan is a particular kind of loan intended to assist companies in controlling their immediate operating costs. It can be used to cover costs like purchasing inventory, paying salaries, and meeting other day-to-day expenses.

Q2. Why is working capital important for MSMEs?

Ans. MSMEs require working capital. It assists businesses to keep a good cash flow, pay suppliers on time and take advantage of growth opportunities.

Q3. What are the different types of working capital loans for MSMEs?

Ans. There are several types of MSMEs loan for working capital available for MSMEs, including:

- Term Loans: For long-term working capital needs.

- Overdraft Facility: Flexible credit to meet short-term requirements.

- Cash Credit: Similar to overdraft, but with a longer tenure.

- Invoice Discounting: Early payment for outstanding invoices.

Q4. How can I improve my chances of getting an MSME working capital loan?

Ans. Good financial records, strong credit history and a ready business plan will help you to increase your chances of securing a MSME loan for working capital. Secondly, look into government schemes and programmes that provide concessional loans or subsidies for MSMEs.

Quick & easy loans for your business growth

Apply NowDisclaimer: The information contained in this post is for general information purposes only. IIFL Finance Limited (including its associates and affiliates) ("the Company") assumes no liability or responsibility for any errors or omissions in the contents of this post and under no circumstances shall the Company be liable for any damage, loss, injury or disappointment etc. suffered by any reader. All information in this post is provided "as is", with no guarantee of completeness, accuracy, timeliness or of the results etc. obtained from the use of this information, and without warranty of any kind, express or implied, including, but not limited to warranties of performance, merchantability and fitness for a particular purpose. Given the changing nature of laws, rules and regulations, there may be delays, omissions or inaccuracies in the information contained in this post. The information on this post is provided with the understanding that the Company is not herein engaged in rendering legal, accounting, tax, or other professional advice and services. As such, it should not be used as a substitute for consultation with professional accounting, tax, legal or other competent advisers. This post may contain views and opinions which are those of the authors and do not necessarily reflect the official policy or position of any other agency or organization. This post may also contain links to external websites that are not provided or maintained by or in any way affiliated with the Company and the Company does not guarantee the accuracy, relevance, timeliness, or completeness of any information on these external websites. Any/ all (Gold/ Personal/ Business) loan product specifications and information that maybe stated in this post are subject to change from time to time, readers are advised to reach out to the Company for current specifications of the said (Gold/ Personal/ Business) loan.