The Challenge

As of the current situation, customer data is dispersed across multiple institutions. Whenever a customer applies for credit, they are obligated to manually furnish a variety of information or present digitally fragmented details to the lender. The historical credit record holds pivotal significance in the assessment of a customer's credit score. Consequently, this poses challenges for individuals seeking credit for the first time.

Through the utilization of Account Aggregators, financial institutions now possess the capability to evaluate diverse data elements concerning customers. These elements encompass facets such as the customer's patterns of cashflow, online expenditure, and the borrower's held assets.

Market

The Indian account aggregation market is expected to grow at a compound annual growth rate (CAGR) of over 20% between 2021 and 2026.

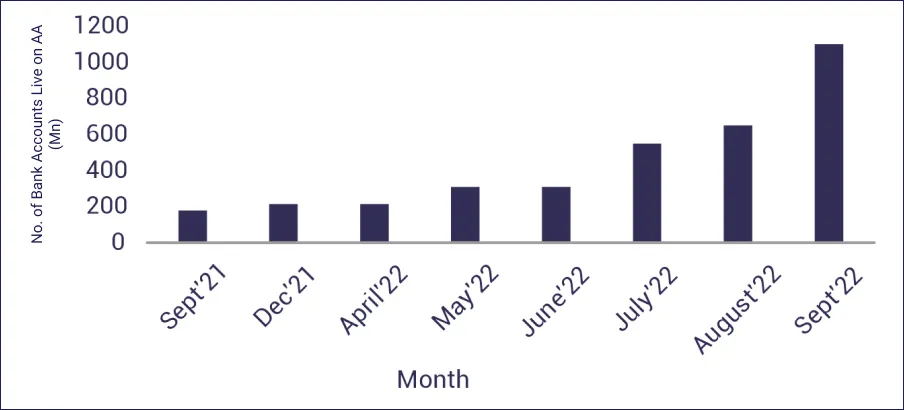

Account Aggregator Ecosystem Growth (Mn)

Annexure I : Market Size of Account Aggregator

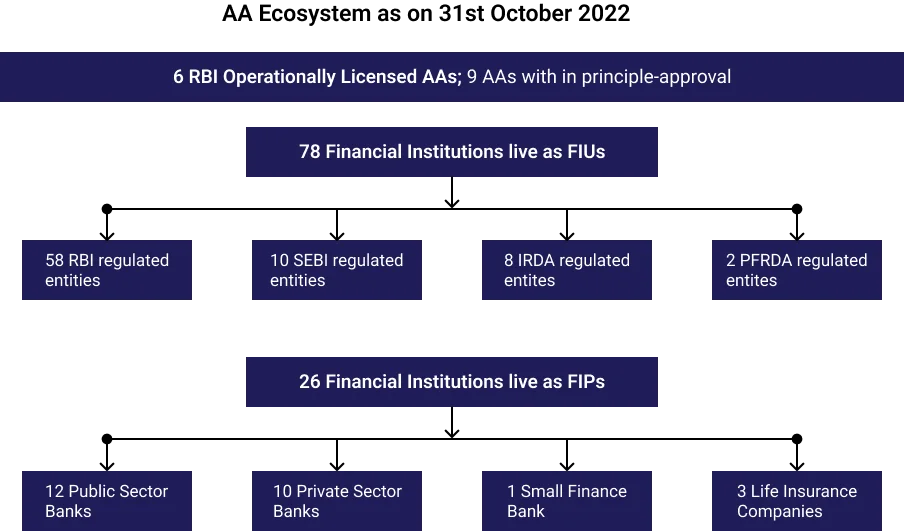

The Economic Survey of India has reported that with 23 banks onboarding the AA platform, more than 1.1 billion bank accounts are currently eligible to share data on the AA system, and already around 3.8 million users have successfully shared data through this platform.

As on 31st December 2022, 27 Financial Institutions have gone live as FIPs, including all 12 PSBs, 10 Private Sector Banks, 1 Small Finance Bank, and 4 Life Insurance Companies. 119 Financial Institutions have gone live as FIUs of which there are 93 RBI Regulated, 12 SEBI Regulated, 12 IRDAI-regulated entities, and 2 PFRDA-regulated entities.

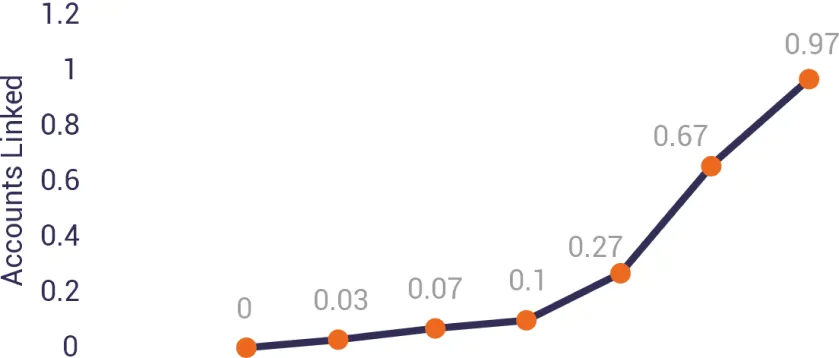

Cumulative Accounts Linked through

Account Holders (In Mn)

Annexure II : Number of users who joined the AA platform as of the first week of July’23

The market size for Account Aggregator can be defined in terms of the number of consents successfully fulfilled, resulting in successful data transfers. As of 31st Oct '22, more than 1.1 billion accounts in the form of singly held savings accounts and sole proprietorship current accounts have been enabled (available to be shared through AAs) on AA

The Solution

Finvu operates as a licensed NBFC Account Aggregator under the supervision of the Reserve Bank of India. Their primary focus lies in establishing a secure platform for sharing reliable data among financial institutions. Finvu offers a framework that facilitates the exchange of information between your financial institution and the users who entrust you with their financial services.

This process involves real-time data sharing based on your consent, employing encryption protocols for data security both during storage and transmission. Finvu provides the platform that enables secure portability of trusted data between financial service providers. With Finvu's certified and standard open API framework, financial institutions will be able to quickly adopt and come on board, while some of them are already working on their digital journeys for various use cases.

IIFL’s Impact

IIFL has been a great partner for our ecosystem as they bring in the knowledge and depth of lending, securities and wealth management landscape. Having worked closely with them on multiple use cases has taken us forward to a leading position and enhanced our product portfolio.