Modify, Cancel & Reject E-Ways Bills Under GST

The GST regime has established many systems to ensure a smooth taxation process. One crucial component of such systems is the electronic way bill or e-Way bill. This works similarly to the invoice you get with the shipment when you order online, only with certain specific conditions. What is the e-Way bill? When is it raised? And how to edit e-Way bill if the mentioned details need changing? Let’s understand.

What Is An E-Way Bill?

An e-way bill is a document that must be carried by the person in charge of a conveyance transporting goods valued over fifty thousand rupees, as required by the Goods and Services Tax (GST) Act. This bill is generated through the GST Common Portal by registered persons or transporters before the goods are moved.

The e-way bill system, introduced in April 2018 under GST, simplifies the movement of goods between states through a paperless digital process. It has two parts: Part A includes details like the recipient's GSTIN, delivery PIN code, invoice or challan details, value of goods, HSN code, transport document number, and transportation reason. Part B contains the transporter's details, such as the vehicle number.

As per Rule 138 of the CGST Rules, 2017, if you’re moving goods worth more than Rs.50,000, you must fill in Part A with the required details. Part B is then used to generate the e-way bill with transport information.

If you're a GST-registered person or transporter, generating an e-way bill is compulsory for transporting goods valued over Rs.50,000 across states. Modifications are allowed in limited cases, like when the vehicle number is missing during generation or if goods need to be transferred to another vehicle due to breakdowns or trans-shipment.

Who Generates The E-Way Bill?

- Registered Persons: If goods worth over Rs.50,000 are moved to or from a registered person, an e-way bill must be generated. Registered persons or transporters can also generate the e-way bill voluntarily for goods worth less than Rs.50,000.

- Unregistered Persons: Even unregistered persons must generate the e-way bill. If an unregistered person supplies goods to a registered person, the receiver must ensure all compliance requirements are met as if they were the supplier.

- Transporters: If the supplier hasn’t done so, the transporter must generate an e-way bill. However, if the total value of all consignments in a vehicle is over Rs.50,000, even if individual consignments are below Rs.50,000, the transporter must generate the e-way bill.

Sapna aapka. Business Loan Humara.

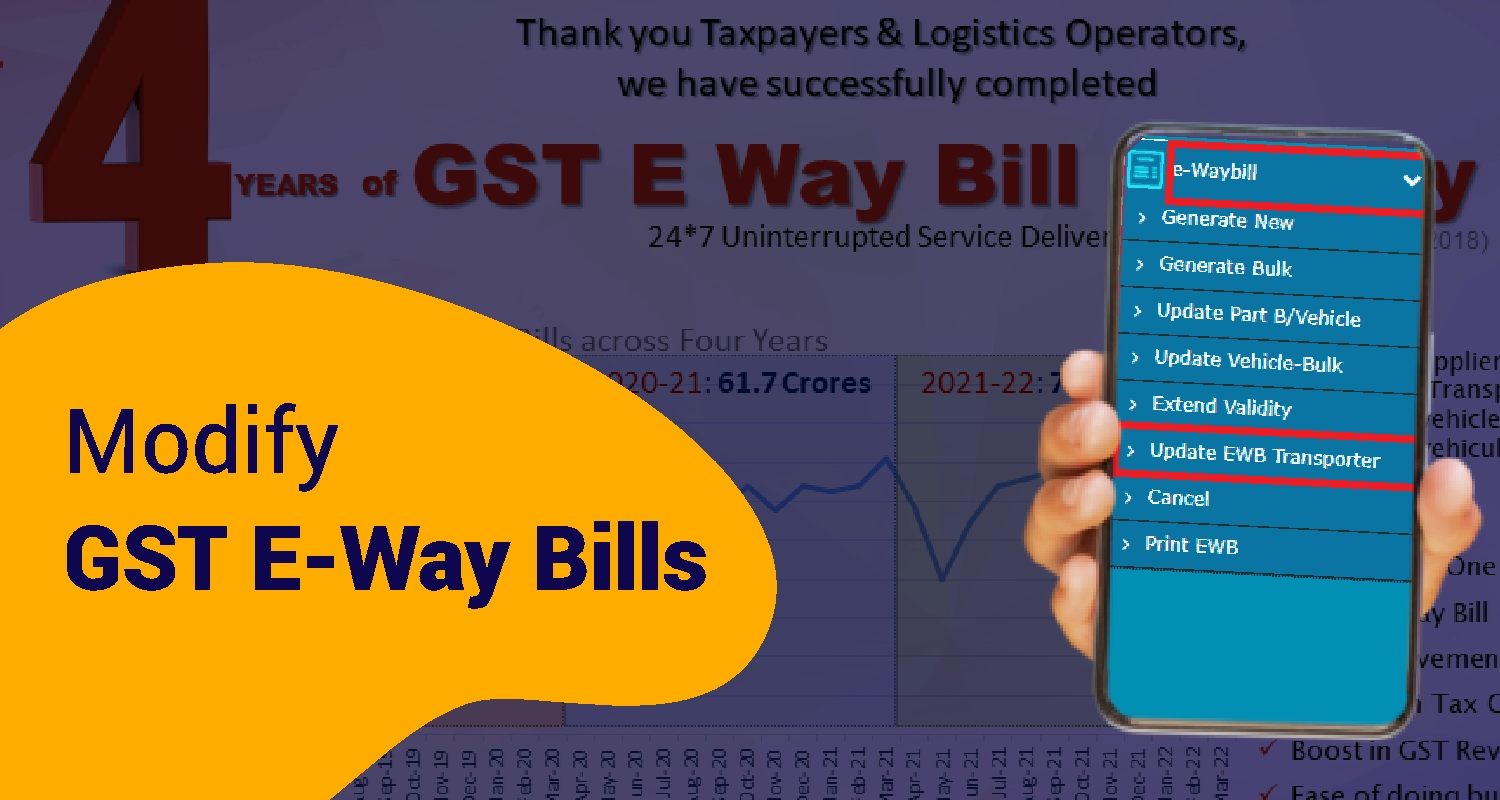

Apply NowHow To Modify E-Way Bill?

There is currently no option to modify Part A of the e-way bill once it's been generated with incorrect details. The e-way bill must be canceled, and a new one must be created with the correct information. If a consignor has filled in Part A, they can assign the e-way bill number (EBN) to another transporter. The transporter can then update Part B of Form GST EWB-01, allowing the goods to continue their journey.

Another case where you can modify an e-Way bill is when the vehicle number was not provided while generating the bill or if the goods are transferred to another vehicle during transit due to the breakdown of the original vehicle or trans-shipment. To modify the e-Way bill,

Step 1: Log in to ewaybillgst.gov.in.

Step 2: From the ‘e-waybill’ dropdown on the left, click ‘Update Vehicle No.’

Step 3: If you need to update the vehicle details in a consolidated e-way bill, click on ‘Re-generate’ under ‘Consolidated EWB.’

Step 4: You can search for your bill by either the ‘e-way bill no.’ or the ‘Generated Date.’ Enter the number or date and click on ‘Go.’

Step 5: Select the e-way bill you want to update.

Step 6: Enter the vehicle number in this format: DL 01 L 0123, along with the place and reason for the update.

Step 7: Choose the reason from options like Transshipment, Vehicle Breakdown, or not updated earlier, and click ‘Submit.’

Step 8: Your e-way bill will be updated instantly.

How To Cancel An E-Way Bill?

If the goods were never transported or not moved as per the e-Way Bill details, the generator can cancel the e-Way Bill. The cancellation must be done within 24 hours of generating the e-Way Bill. Once canceled, the e-Way Bill cannot be used. And if an empowered officer has already verified it, it cannot be canceled. The steps to cancel the e-Way bill are as follows-

Step 1: Click on ‘e-way bill’ or ‘Consolidated EWB’ and select ‘Cancel’ from the dropdown menu.

Step 2: Enter the 12-digit E-Way Bill number you wish to cancel and click ‘Go.’

Step 3: The selected E-Way Bill will appear. Provide a valid reason for cancellation, such as "goods are not being moved" or "incorrect entry in the e-Way Bill."

Apart from cancellation, it is also essential to know about the option of rejecting an e-Way bill.

How To Reject An E-Way Bill?

As a taxpayer, you can reject e-way bills others generate on your GSTIN. For example, if a consignment didn’t reach its destination because it was canceled on the way, you can reject the e-way bill. To do this, you’ll need the date the bill was generated and the e-way bill number.

Step 1: Log in and select the ‘Reject’ option.

Step 2: After clicking ‘Reject,’ a screen showing e-way bills generated by others with the date will appear.

Step 3: Set the date when the bill was generated and click ‘Submit.’ This will show you a list of e-way bills from that date.

Step 4: Tick the e-way bill you want to reject on the right-hand side.

Step 5: Once done, a message will appear confirming the successful rejection of the e-way bill.

As the second party, you must communicate the rejection or acceptance of the consignment within 72 hours of the e-way bill's generation; otherwise, it’s considered accepted.

Validity Of An E-Way Bill Under GST:

The validity of a GST e-Way bill depends on the distance the goods need to travel. For distances under 100 km, the bill is valid for one day from the date it’s generated. For every additional 100 km, the validity increases by one more day. The "relevant date" is when the e-way bill is generated, and each day is counted as 24 hours.

Generally, the validity cannot be extended. However, the Commissioner can extend it for certain goods through a notification. If, due to exceptional circumstances, goods can't be transported within the validity period, the transporter can generate a new e-way bill by updating details in Part B of FORM GST EWB-01.

The validity can be extended by the transporter carrying the goods at the time of expiry. While doing so, the transporter submits the bill number, the reason for the extension, the approximate distance to be traveled, and other Part B details. The option to extend is available within eight hours before the bill's expiry.

To extend the validity-

Step 1: Log in to the portal and select the 'Extend validity' option under 'E-waybill' on the dashboard.

Step 2: Enter the e-way bill number for which you want an extension.

Step 3: When the e-way bill appears, click ‘Yes’ to the question, "Do you wish to get an extension for this EWB?" at the bottom. Provide the reason for the extension and re-enter details like distance, place of dispatch, and delivery.

Remember, once the validity is extended, a new e-way bill number will be assigned. The details in Part A cannot be changed, and the extended validity will apply to the remaining distance.

Conclusion

The e-way bill under GST creates a uniform rule across the country. This shift from physical to digital processes makes it easier to move goods faster. It reduces vehicle turnaround time, improves logistics, and increases the distances vehicles travel. This not only cuts down travel time but also lowers costs. To make the most of this system, it's crucial to understand all the details of the e-way bill.

FAQs:

Q1. How to modify e-Way bill after 72 hours?Ans. Normally, you can't cancel an E-way bill after 72 hours as per GST rules. The E-way bill is for goods in transit and gets canceled within 24 hours if the goods don’t move. However, if you have a valid reason for not transporting the goods or an error in the bill, the GST portal may allow you to cancel it after 72 hours.

Q2. Who can modify the vehicle details in Part B?Ans. The Supplier, Transporter, or Recipient can update the vehicle details in Part B for the goods transported.

Q3. What should be done if there is a mistake in generating an e-Way bill under GST?Ans. You will need to cancel the incorrect e-Way bill and generate a new one. However, remember to cancel the bill within the 24-hour window.

Sapna aapka. Business Loan Humara.

Apply NowDisclaimer: The information contained in this post is for general information purposes only. IIFL Finance Limited (including its associates and affiliates) ("the Company") assumes no liability or responsibility for any errors or omissions in the contents of this post and under no circumstances shall the Company be liable for any damage, loss, injury or disappointment etc. suffered by any reader. All information in this post is provided "as is", with no guarantee of completeness, accuracy, timeliness or of the results etc. obtained from the use of this information, and without warranty of any kind, express or implied, including, but not limited to warranties of performance, merchantability and fitness for a particular purpose. Given the changing nature of laws, rules and regulations, there may be delays, omissions or inaccuracies in the information contained in this post. The information on this post is provided with the understanding that the Company is not herein engaged in rendering legal, accounting, tax, or other professional advice and services. As such, it should not be used as a substitute for consultation with professional accounting, tax, legal or other competent advisers. This post may contain views and opinions which are those of the authors and do not necessarily reflect the official policy or position of any other agency or organization. This post may also contain links to external websites that are not provided or maintained by or in any way affiliated with the Company and the Company does not guarantee the accuracy, relevance, timeliness, or completeness of any information on these external websites. Any/ all (Gold/ Personal/ Business) loan product specifications and information that maybe stated in this post are subject to change from time to time, readers are advised to reach out to the Company for current specifications of the said (Gold/ Personal/ Business) loan.