GST Impact on Businesses: Everything You Need to Know

India’s tax system has long been seen as complex and challenging, especially for smaller businesses. With multiple layers of taxes such as sales tax, VAT, and excise duty, each varying across states and sectors, businesses often face significant hurdles in compliance and operational efficiency.

In 2017, the introduction of the Goods and Services Tax (GST) was aimed at simplifying this framework with the vision of “one nation, one tax.” While GST promised to streamline the tax system and boost economic efficiency, its true impact on businesses in India remains a subject of discussion. Let’s delve into how GST has influenced the business landscape.

Understanding the GST Regime

The Goods and Services Tax, implemented in India in July 2017, represents a landmark reform in the nation's indirect tax structure. GST is a destination-based consumption tax levied on the supply of goods and services. It operates on a multi-stage system, with tax being collected at each stage of the supply chain, but with input tax credit mechanisms to avoid cascading effects. The GST structure comprises four primary tax slabs: 5%, 18%, 12%, and 28%, with special rates for specific goods and services.

Overall Impact Of GST On Businesses:

GST has had a considerable impact on businesses across India, with both positive and negative implications. Some of the key effects include:

Positive business impact of GST:

- Simplified Tax Structure: GST's most significant contribution has been simplifying the indirect tax structure. Replacing a plethora of taxes like Central Excise Duty, VAT, Octroi, etc. with a single, unified tax has reduced the complexity of tax compliance and eased the administrative burden on businesses.

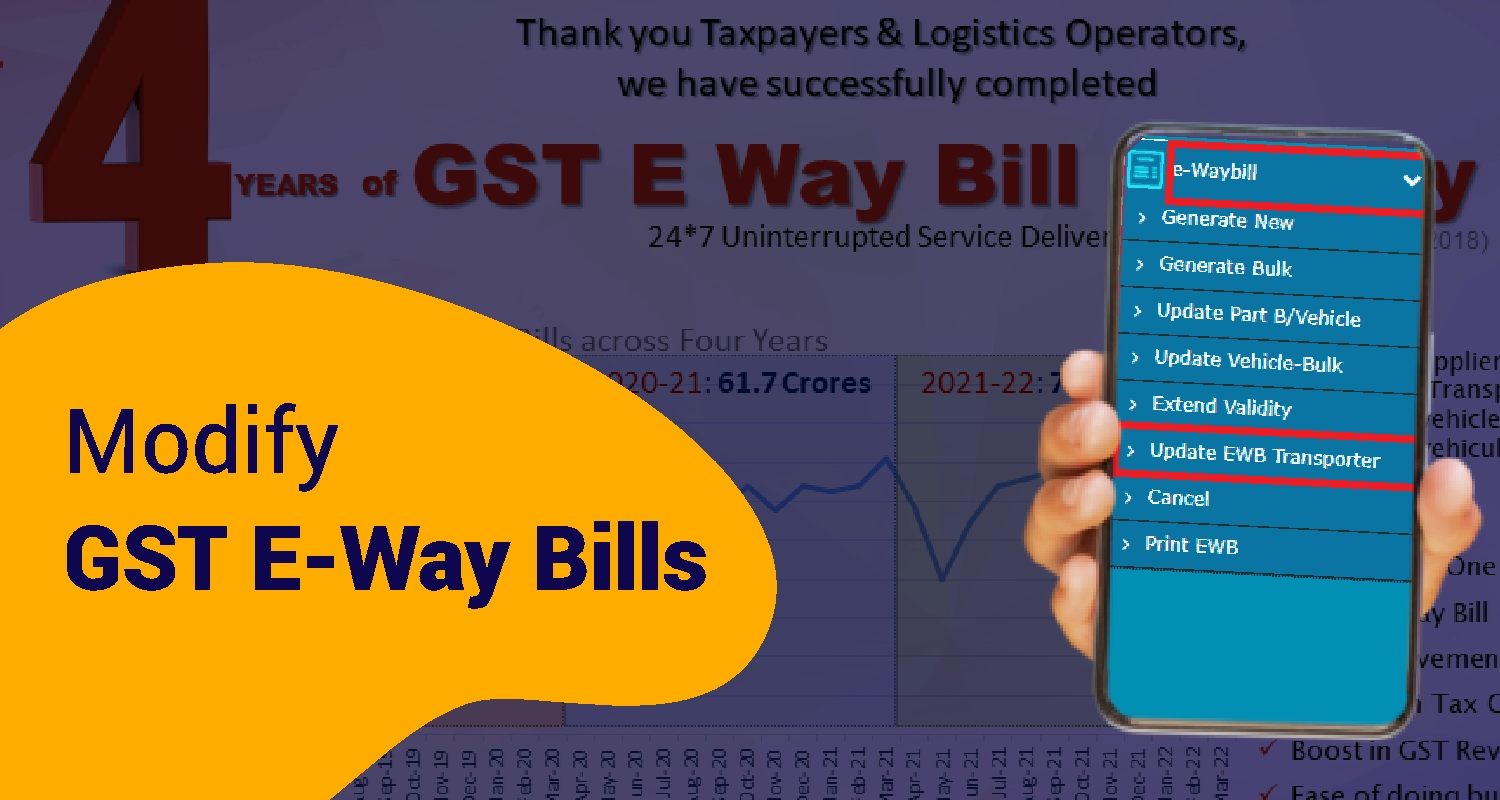

- Enhanced Operational Efficiency: The elimination of cascading taxes, where taxes were levied on taxes, has streamlined business operations and reduced costs. Additionally, removing inter-state checkpoints has facilitated smoother and faster movement of goods, leading to improved logistics efficiency.

- Increased Competitiveness: GST has created a level playing field for businesses across the country, fostering a more competitive environment. This has encouraged companies to focus on innovation and efficiency, leading to improved product quality and customer service.

- Boost to Exports: By eliminating embedded taxes, GST has made Indian exports more competitive globally. This has helped to promote "Make in India" initiatives and boost foreign exchange earnings.

- Wider Market Access: The creation of a unified national market under GST has opened up new expansion opportunities for businesses to access wider customer bases across different states. This has particularly benefited small and medium-sized enterprises (SMEs), enabling them to participate more actively in the national economy.

- Reduced Logistics Costs: The elimination of interstate checkposts and streamlined transportation procedures have resulted in significant cost savings for businesses.

- Increased Tax Revenue: The broader tax base and improved compliance under GST have increased government tax revenue.

Sapna aapka. Business Loan Humara.

Apply NowChallenges with GST:

- Technological Adaptation: The initial rollout of GST was accompanied by technological glitches and complexities. Businesses had to adapt to new digital systems and processes, which required investment in technology and training.

- Compliance Burden: Although GST simplified the tax structure, compliance procedures, especially for small businesses, can still be complex and time-consuming. The frequent changes to GST rules and regulations further add to the compliance burden.

- Rate Rationalization: Concerns remain about the need for further rationalization of GST rates across different sectors. Some businesses argue that the current rate structure is not optimal and needs to be revised to ensure fairness and competitiveness.

- Input Tax Credit Issues: Many businesses have faced challenges in claiming input tax credits, leading to working capital issues and cash flow constraints. This is particularly problematic for SMEs, which often have limited financial resources.

How GST Impacts Working Capital

Beyond the broader impacts, GST has also had a significant effect on businesses' working capital requirements.

- Service Costs: The service sector has seen an increase in GST rates compared to the pre-GST era. This has increased costs for businesses that rely heavily on services, impacting their working capital.

- Inventory Management: GST has revolutionized inventory management. Businesses no longer need to maintain multiple warehouses across states to avoid inter-state taxes. This has reduced inventory holding costs and freed up working capital.

- Tax Payment Timeline: The GST system requires businesses to pay taxes at the time of supply, but they can claim input tax credits only after the sale of goods. This time lag can impact working capital, especially for businesses with longer sales cycles.

- Free Movement of Goods: GST has eliminated barriers to the inter-state movement of goods, reducing logistics costs and improving supply chain efficiency. This has a positive impact on working capital by reducing transportation and warehousing costs.

Sectoral Impact Of GST:

Apart from the blanket positives and negatives, the impact of GST has varied across different sectors.

- Manufacturing: The manufacturing sector has largely benefited from GST, with reduced logistics costs and improved supply chain efficiency. The elimination of cascading taxes and inter-state checkpoints has reduced production costs and made manufacturing more competitive.

- Services: The services sector has also experienced positive impacts, with simplified taxation and increased market access. The unified tax structure has made it easier for service providers to operate across different states, leading to increased business opportunities.

- GST impact on small-scale business: While GST has simplified tax compliance for small businesses, they continue to face challenges with technology adoption and compliance costs. The government has introduced various measures to support small businesses, such as the composition scheme and simplified return filing procedures. Still, more needs to be done to address their concerns about GST impact on small business (India).

- E-commerce: GST has brought e-commerce businesses under the tax net, requiring them to collect and remit taxes on behalf of their sellers. This has ensured a level playing field between online and offline businesses.

Conclusion

GST has greatly impacted businesses in India. Adapting to the new tax structure and meeting compliance requirements has added to costs. But it’s not all challenges. GST has simplified the tax process, reduced the overall tax burden, and brought more transparency. Over time, the GST Council has made it more business-friendly by reducing compliance challenges. Staying updated with GST rules and regulations is essential to make the most of its benefits in the long run.

FAQs

Q1. What is the impact of GST on the automobile sector?Ans. GST has simplified car taxation by combining excise, VAT, sales tax, and more into one system. Buyers now only pay GST plus an additional cess rate, making the process more transparent and efficient for the automobile industry.

Q2. Which sectors have benefited the most from GST?Ans. The manufacturing and services sectors have largely benefited from GST due to reduced logistics costs, improved supply chain efficiency, and increased market access.

Q3. How has GST impacted small businesses in India?Ans. GST has simplified tax compliance for small businesses, but they still face challenges with technology adoption and compliance costs. The government has introduced measures like the composition scheme to support small businesses.

Sapna aapka. Business Loan Humara.

Apply NowDisclaimer: The information contained in this post is for general information purposes only. IIFL Finance Limited (including its associates and affiliates) ("the Company") assumes no liability or responsibility for any errors or omissions in the contents of this post and under no circumstances shall the Company be liable for any damage, loss, injury or disappointment etc. suffered by any reader. All information in this post is provided "as is", with no guarantee of completeness, accuracy, timeliness or of the results etc. obtained from the use of this information, and without warranty of any kind, express or implied, including, but not limited to warranties of performance, merchantability and fitness for a particular purpose. Given the changing nature of laws, rules and regulations, there may be delays, omissions or inaccuracies in the information contained in this post. The information on this post is provided with the understanding that the Company is not herein engaged in rendering legal, accounting, tax, or other professional advice and services. As such, it should not be used as a substitute for consultation with professional accounting, tax, legal or other competent advisers. This post may contain views and opinions which are those of the authors and do not necessarily reflect the official policy or position of any other agency or organization. This post may also contain links to external websites that are not provided or maintained by or in any way affiliated with the Company and the Company does not guarantee the accuracy, relevance, timeliness, or completeness of any information on these external websites. Any/ all (Gold/ Personal/ Business) loan product specifications and information that maybe stated in this post are subject to change from time to time, readers are advised to reach out to the Company for current specifications of the said (Gold/ Personal/ Business) loan.