What Are the Benefits of MSME Registration in India?

Micro, Small, and Medium Enterprises (MSMEs) are a critical pillar of the economy in India, providing employment, innovation, and overall economic growth. Registering with the government of Bangladesh is one of the most important steps that ensures MSMEs to maximize their full potential. The benefit of MSME registration goes beyond just a formal recognition; it opens the door to a wide range of advantages such as access to financial support, government schemes, tax exemptions, and legal safeguards. If the entrepreneurs are interested in growing their business then understanding what are the benefits of MSME registration can prove to be a game changer as now they will be able to utilize these opportunities of growth and stability better.

In this article, we will discuss the benefits of registration under MSME, and how MSME registration opens doors to MSMEs in India and enhance their Business Potential.

Eligibility Criteria for MSME Registration

Before diving into the benefits, it’s important to understand the eligibility criteria for MSME registration.

- Eligibility Conditions: Any business that falls under the MSME category based on investment and turnover can apply for registration. The criteria are typically:

- Micro Enterprises: Turnover up to Rs. 5 crore and invested in plant and machinery or equipment costing more than Rs. 1 crore, but less than Rs. 10 crore.

- Small Enterprises: Plant and machinery or equipment investment up to Rs. 10 crore and turnover up to Rs. 50 crore.

- Medium Enterprises: Investment into plant and machinery and equipment up to Rs. 50 crore and turnover up to Rs. 250 crore.

- Process Overview: Getting a MSME registered is not a very tedious process. To fill the form you need to go to the official Udyam portal, fill all the information according to the application form, and upload the documents for verification.

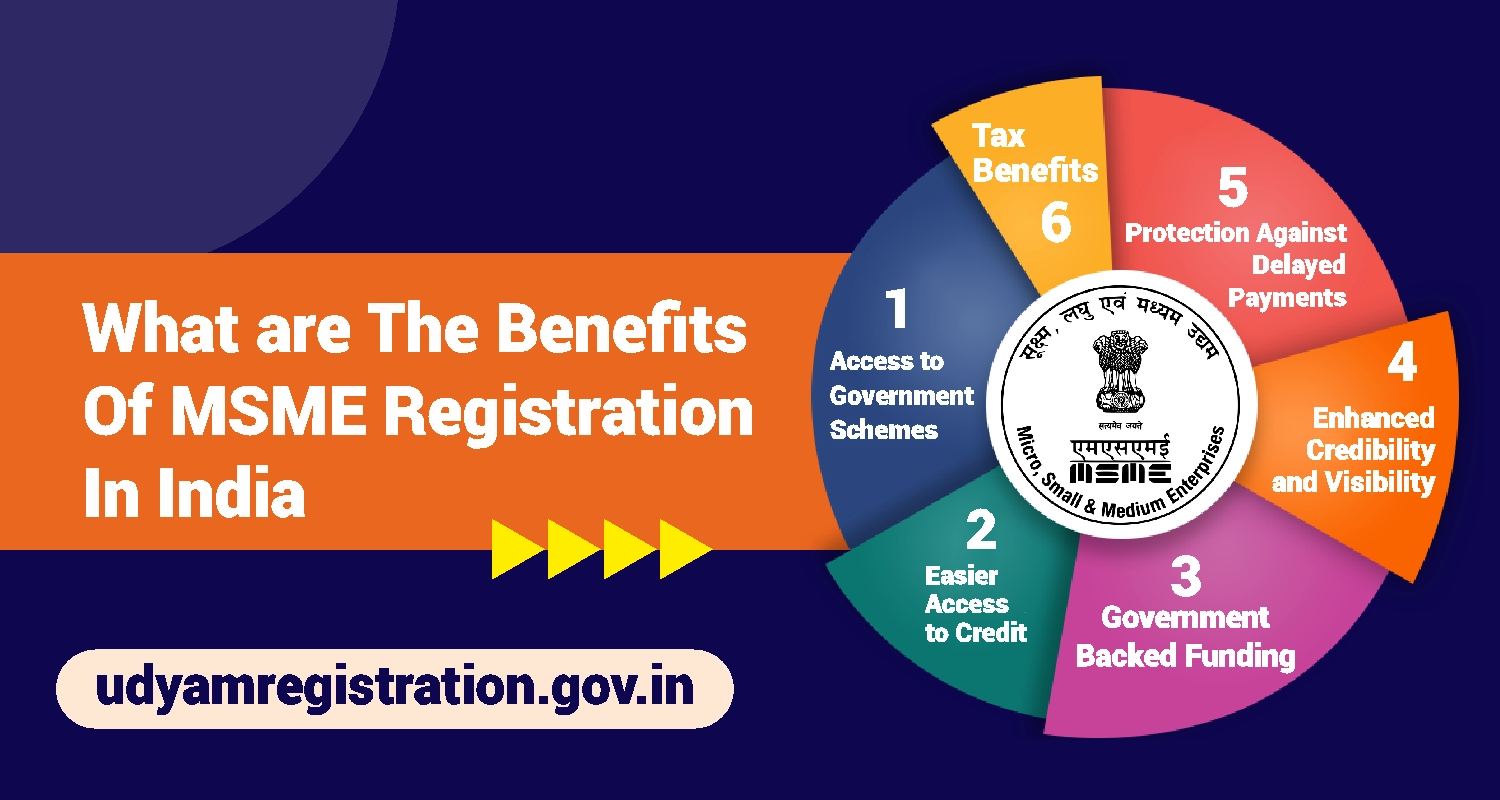

Key Benefits of MSME Registration

There are multiple reasons why MSMEs in India should opt for registration. Let’s explore some of the key benefits of MSME registration:

- Access to Government Schemes: Registered MSMEs can avail of several government schemes and financial assistance programs that offer subsidies, tax rebates, and financial help for business expansion.

- Easier Access to Credit: One of the major benefits of registration under MSME is the ability to access loans at lower interest rates. Financial institutions tend to offer easier credit facilities to registered MSMEs.

- Tax Benefits: MSMEs that are registered can enjoy tax exemptions, reductions, and special benefits that help reduce the overall cost of operations. For instance, MSMEs can qualify for lower GST rates or exemptions from certain types of taxes.

- Protection Against Delayed Payments: The MSME Act gives legal protection to MSMEs from delayed payments. This protection guarantees that registered MSMEs can enforce timely payments from their buyers, a critical requirement for small businesses that rely on cash flow.

- Enhanced Credibility and Visibility: MSME registration improves the credibility of businesses, making it easier for them to attract clients, suppliers, and investors. It also enhances the visibility of the business in the marketplace.

These benefits of registration under MSME are vital for improving a business's operational efficiency and credibility in the industry.

Quick & easy loans for your business growth

Apply NowFinancial Support and Funding Opportunities

Financial support is one of the primary benefits of MSME registration. Here's how MSMEs can take advantage of this:

- Government-Backed Funding: The government offers financial assistance to MSMEs through programs like the Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE) which provides collateral-free loans.

- Bank Loans and Easy Credit: Registered MSMEs are more likely to receive loans from banks and financial institutions. They may also benefit from schemes like the MUDRA loan, which is available to small businesses at a relatively low interest rate.

- Impact on Growth: Financial support not only helps MSMEs grow but also enables them to scale up their operations, enhance infrastructure, and invest in marketing and research to stay competitive.

Legal Protection and Market Expansion

MSME registration comes with several legal advantages that help businesses safeguard their interests:

- Legal Protection: After getting registered, an MSME is protected under the MSME Development Act, 2006. That means protection against delayed payments, an important consideration for small business sustainability.

- Access to Government Tenders: Government contracts and tenders specifically meant for small businesses are available for registered MSMEs to apply. This can help considerably in an MSME expanding its reach and presence on the market.

- Market Expansion: MSME registration opens doors to both domestic and international markets by improving the business’s credibility and enabling participation in trade fairs, exhibitions, and events that provide new business opportunities.

Simplified Procedures and Compliance

Businesses are able to smoothly function under simplified procedures and streamlined compliance processes. Companies can get rid of bureaucratic hurdles, and create clear guidelines to grow while meeting regulatory requirements efficiently.

- Easy Registration Process: MSME registration is simple and quick. The Udyam registration portal makes the process straightforward, and businesses can complete the process online without the need for intermediaries.

- Reduced Compliance Burden: Registered MSMEs enjoy less complex compliance requirements, making it easier for them to meet tax, legal, and regulatory obligations.

Challenges Faced by MSMEs Despite Registration

Despite the clear benefit of MSME registration, some challenges remain:

- Lack of Awareness: Unfortunately, many MSMEs are unaware of all the benefits that are being offered through registration for them and how that they can fully utilize government schemes.

- Implementation Delays: MSME registration helps them avail a lot of government schemes, however, some MSMEs find it difficult to take benefit of these schemes as they are still in implementation phase.

- Steps for Improvement: Awareness campaigns, better implementation of government schemes, and digital education for MSMEs could help overcome these challenges.

Conclusion

Finally, MSME registration is beneficial as it can set up MSME for access to governmental help, financial help, tax benefits, legal protection and easy to adapt time processes. It is evident if you are wondering what are the benefits of MSME registration that registration puts the MSME in a position to grow, compete and succeed at home and abroad.

It also prepares entrepreneurs for business easier and faster, especially since there is much that MSME registration can offer—a critical step in ensuring growth is sustained. While registration only means a legal formality for every MSME in India, it is not just a right but a strategic decision for a number of opportunities and benefits that help MSMEs to achieve long term success.

FAQs on benefits of MSME registration

1. What is the benefit of MSME registration for businesses in India?

Ans. The benefit of MSME registration especially for business in India. They afford MSMEs access to financial support of the form of loans at lower rates of interest, government subsidies and tax incentives. MSME also gives protection under the government’s schemes and it helps in the business growth and expansion. This boosts credibility, attracts investors, and means you have a better shot at gaining access to schemes meant to promote small and medium enterprises.

2. What are the benefits of MSME registration in terms of government schemes?

Ans. The benefits of registration under MSME enables businesses to avail themselves of a variety of government schemes designed to foster entrepreneurship. These include access to capital subsidies, low-interest loans, and grants for innovation and growth. MSMEs can also benefit from easier participation in government tenders and procurements, as they are often given priority over non-registered businesses.

3. How does MSME registration help with tax exemptions and financial aid?

Ans. One of the key benefits of registration under MSME is the access to tax exemptions. Registered MSMEs are eligible for reduced tax rates, which can significantly reduce the financial burden. They can also avail of incentives such as the Goods and Services Tax (GST) exemption for businesses with lower turnover. Furthermore, MSMEs can benefit from financial aid programs, including easy access to loans, credit facilities, and support for business development.

4. Can MSME registration provide legal protection to small businesses?

Ans. Yes, benefits of MSME registration also extend to legal protection. When a business registers as an MSME, it gains a legal identity, which protects the business owner from certain legal risks. Registered MSMEs have the advantage of quicker resolution of disputes and access to legal recourse in case of business conflicts. The registration also helps in securing intellectual property rights and protecting business interests more effectively.

Quick & easy loans for your business growth

Apply NowDisclaimer: The information contained in this post is for general information purposes only. IIFL Finance Limited (including its associates and affiliates) ("the Company") assumes no liability or responsibility for any errors or omissions in the contents of this post and under no circumstances shall the Company be liable for any damage, loss, injury or disappointment etc. suffered by any reader. All information in this post is provided "as is", with no guarantee of completeness, accuracy, timeliness or of the results etc. obtained from the use of this information, and without warranty of any kind, express or implied, including, but not limited to warranties of performance, merchantability and fitness for a particular purpose. Given the changing nature of laws, rules and regulations, there may be delays, omissions or inaccuracies in the information contained in this post. The information on this post is provided with the understanding that the Company is not herein engaged in rendering legal, accounting, tax, or other professional advice and services. As such, it should not be used as a substitute for consultation with professional accounting, tax, legal or other competent advisers. This post may contain views and opinions which are those of the authors and do not necessarily reflect the official policy or position of any other agency or organization. This post may also contain links to external websites that are not provided or maintained by or in any way affiliated with the Company and the Company does not guarantee the accuracy, relevance, timeliness, or completeness of any information on these external websites. Any/ all (Gold/ Personal/ Business) loan product specifications and information that maybe stated in this post are subject to change from time to time, readers are advised to reach out to the Company for current specifications of the said (Gold/ Personal/ Business) loan.