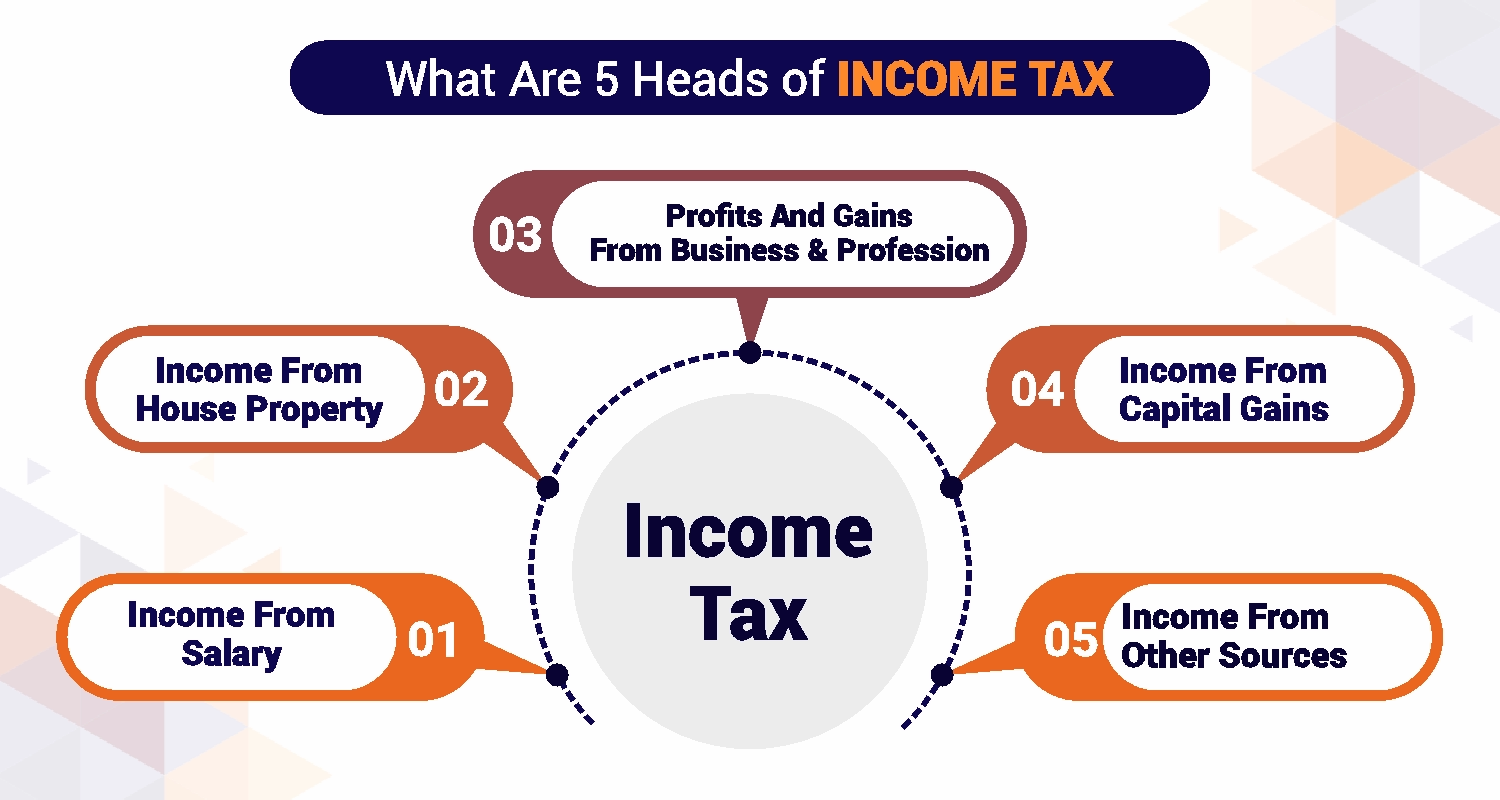

5 Heads of Income Tax in India: A Complete Guide

People and businesses earn income from multiple sources like interest, salary, profits, consultation, rent, and dividend income. When paying your taxes, it gets difficult for both the payer and the collector (Government) to maintain uniformity in the bifurcation and treat each income right. This is why the Income Tax Act has specified proper bifurcations for every type of income into five different heads of income. What are the five heads of income tax? Let's understand.

1. Income From Salary:

Salary is the remuneration an employer pays to an employee under a contract of employment. Sections 15 to Section 17 of the Income Tax Act cover tax treatment of salary income. Salary includes monetary and non-monetary benefits that include components like basic salary, bonus, gratuity, pension, and leave encashment. The tax treatment for the primary components of salary are as follows:

House Rent Allowance (HRA) helps you pay rent if you live in a rented house. It is partly taxable, and the exemption is based on the least of these:

- 50% of basic salary in metros (40% in non-metros)

- Actual HRA received

- Rent paid minus 10% of basic salary

- Leave Travel Allowance (LTA) is for vacation travel in India. It is exempt if you provide proof, like tickets. The exemption is for travel expenses via the shortest, cheapest route and covers family members who live with you.

- Standard Deduction of Rs.50,000 applies to all salaried employees, replacing earlier transport and medical allowances.

Other allowances, like those for children’s education or travel, have varied tax treatments. Some are fully taxable, while others are exempt within limits. Section 10 of the Income Tax Act provides the complete list of allowances and their tax details.

Apart from the allowed exemptions, you also get deductions under salary income. These include:

- Professional tax (deducted by employer)

- TDS (Tax Deducted at Source)

- EMployee’s PPF contribution

Sapna aapka. Business Loan Humara.

Apply Now2. Income From House Property:

Sections 22 to 27 of the Income Tax Act, 1961 cover the Income from House Property. This head of income tax includes the tax on income earned from house property or land attached to it. In simple terms, it lays out how rental income from properties is taxed. Income from House Property is classified into three categories:

- Self-Occupied Property

- Let-Out Property

- Deemed Let-Out Property

If someone owns more than two self-occupied houses, only two are treated as self-occupied, while the rest are deemed let out. The taxation applies to income from both residential and commercial properties.

To compute the income from house property, a few important concepts to know are-

- Gross Annual Value (GAV) is the expected annual rent of a property. It depends on actual rent, municipal valuation, fair rent, and standard rent as per the Rent Control Act.

- Net Annual Value (NAV) is the taxable income from the property after deducting municipal taxes and vacancy loss. NAV = GAV Municipal taxes Vacancy loss.

- Tax Benefits:

- Section 24 allows a 30% standard deduction on NAV and interest on home loans (up to Rs.2 lakh if completed within five years).

- Section 80EE offers a Rs.50,000 deduction for loans sanctioned in 2016–2017, with limits on property value and loan amount.

- Section 80EEA provides a Rs.1.5 lakh deduction for loans taken between 2019 and 2022 for affordable housing.

3. Profits And Gains From Business and Profession:

This head of income tax includes individuals, partnerships, or corporations involved in trade, business, or professional activities. All earnings from such operations fall under this head of income. Income is calculated by subtracting business-related expenses like salaries, rent, depreciation, and utilities from total revenue. This is one of the most comprehensive income categories, covering nearly all income from business or professional activities. Income sources, mentioned in Section 28, include:

- Profits or gains from any business or profession.

- Payments received for termination or modification of contracts or agency terms.

- Sums received from a keyman insurance policy taken for critical employees or partners.

- Profits from government export schemes like the Duty Drawback or Duty-Free Replenishment Certificate.

- Income from selling capital assets held as stock-in-trade, such as art or historical collections held as stock-in-trade.

- Interest, salary, or bonuses earned as a partner in a firm.

- Payments for using intellectual property, technical knowledge, trademarks, or franchises.

- Earnings from providing industrial, scientific, or commercial rights or services.

4. Income From Capital Gains:

When you sell a capital asset and make a profit, that profit is taxed as capital gains and taxed under this head of income tax. Common capital assets include stocks, real estate, gold, bonds, and mutual funds. Capital gains are of two types:

- Short-term Capital Gains: Profits from selling assets held for less than 12 months (e.g., stocks)

- Long-term Capital Gains: Profits from assets held for over 24 months (e.g., real estate)

Tax rates depend on the asset and holding period. For example, long-term capital gains (LTCG) from listed equity shares are taxed at 12.5%, while short-term gains are taxed at 20%. Capital gains should be reported in Schedule CG of your ITR.

There are also exemptions for capital gains:

- Section 54: Exemption on LTCG from selling residential property if reinvested in another property.

- Section 54B: Exemption on capital gains from selling agricultural land, and if reinvested, in new agricultural land.

- Section 54EC: Exemption on LTCG if invested in specified bonds within six months of transfer.

5. Income From Other Sources:

The fifth head of income is a catch-all category that covers any income not taxed under salary, house property, business/profession, or capital gains. This head of income tax, under Section 56(2) of the Income Tax Act, includes earnings from various sources that don’t fall under the other four heads. Some examples are:

- Dividends from domestic or foreign companies

- Interest from savings accounts, fixed deposits, bonds, and debentures

- Winnings from lotteries, crossword puzzles, races, gambling, and betting

- Gifts received in cash or kind from anyone

- Income from subletting house property

- Income from royalties, patents, or copyrights

- Income from undisclosed sources or unexplained investments

- Any other income not covered by the other heads

Understanding the five heads of income tax is key when filing your taxes. Each head has its own rules for exemptions, deductions, and tax rates, so it’s important to classify your income correctly. Knowing which head applies to your earnings can help you reduce your tax liability and avoid penalties, whether it's salary income, rental income from property, or profits from selling investments. When filing your taxes, make sure you’re categorizing your income under the right head to keep things smooth.

Sapna aapka. Business Loan Humara.

Apply NowDisclaimer: The information contained in this post is for general information purposes only. IIFL Finance Limited (including its associates and affiliates) ("the Company") assumes no liability or responsibility for any errors or omissions in the contents of this post and under no circumstances shall the Company be liable for any damage, loss, injury or disappointment etc. suffered by any reader. All information in this post is provided "as is", with no guarantee of completeness, accuracy, timeliness or of the results etc. obtained from the use of this information, and without warranty of any kind, express or implied, including, but not limited to warranties of performance, merchantability and fitness for a particular purpose. Given the changing nature of laws, rules and regulations, there may be delays, omissions or inaccuracies in the information contained in this post. The information on this post is provided with the understanding that the Company is not herein engaged in rendering legal, accounting, tax, or other professional advice and services. As such, it should not be used as a substitute for consultation with professional accounting, tax, legal or other competent advisers. This post may contain views and opinions which are those of the authors and do not necessarily reflect the official policy or position of any other agency or organization. This post may also contain links to external websites that are not provided or maintained by or in any way affiliated with the Company and the Company does not guarantee the accuracy, relevance, timeliness, or completeness of any information on these external websites. Any/ all (Gold/ Personal/ Business) loan product specifications and information that maybe stated in this post are subject to change from time to time, readers are advised to reach out to the Company for current specifications of the said (Gold/ Personal/ Business) loan.