Types of Taxes in India: A Complete Guide

Taxes are an important part of any country’s financial system, as they help the government pay for things like roads, schools, hospitals, and other important public services. In India, there are mainly two main types of taxes: direct taxes and indirect taxes. Understanding these types of taxes is important because they affect how much individuals and businesses pay, and how the overall economy functions.

Let’s take a closer look at the different types of taxes, the difference between direct and indirect taxes, and how they work in India.

What Are the different Types of Taxes in India?

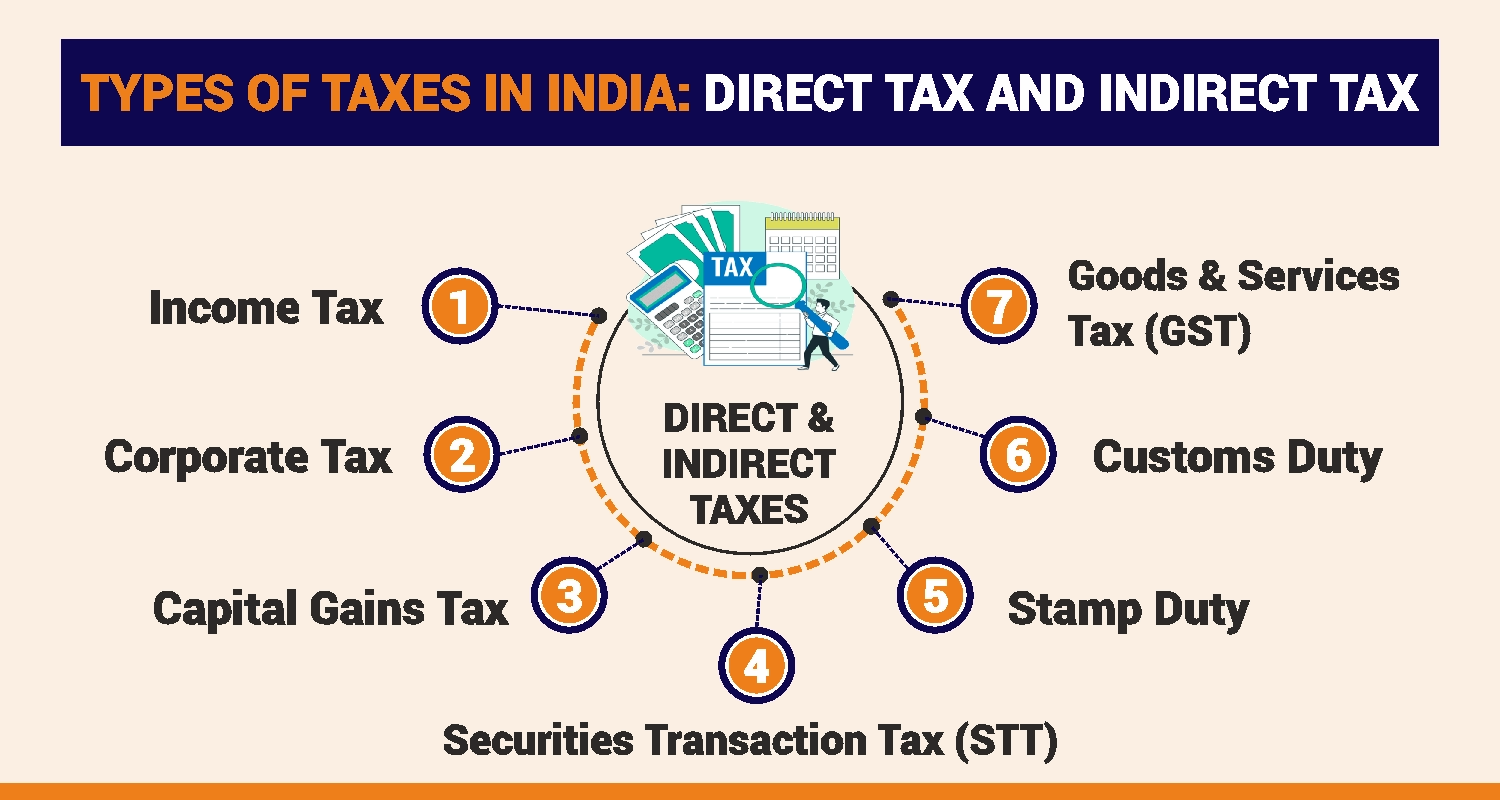

Taxes in India are broadly categorized into two main types:

- Direct Taxes

- Indirect Taxes

Each type of tax serves a distinct purpose and is levied differently. Below, we will delve into these categories and provide examples to help you grasp how they operate.

Direct Taxes

Direct taxes are those types of taxes that are levied directly on individuals or organizations. These taxes are paid directly to the government without involving intermediaries. The burden of paying direct taxes cannot be transferred to another party.

Types of Direct Taxes

1. Income Tax

- Levied on the earnings of Hindu Undivided Families (HUFs), individuals, and other organisations.

- The types of income tax include taxes on salaries, income from house property, capital gains, business profits, and other sources.

- Income tax rates vary based on income slabs defined by the government annually in the Union Budget.

- Paid by companies on their profits.

- The rates differ for domestic companies and foreign entities operating in India.

- Previously levied on the value of assets owned by individuals or companies.

- Applied to the profits earned from the sale of capital assets such as property, stocks, or bonds.

- It is further classified into short-term and long-term capital gains tax, depending on the holding period of the asset.

- Imposed on transactions involving securities like shares and mutual funds traded on stock exchanges.

Key Features of Direct Taxes

- The government receives payment directly from the taxpayer.

- Progressive in nature, which means that as income levels rise, so does the tax rate.

- Promotes equitable wealth distribution.

Sapna aapka. Business Loan Humara.

Apply NowIndirect Taxes

Indirect taxes are levied on goods and services. Unlike direct taxes, the burden of paying indirect taxes can be passed on to the end consumer. These taxes are collected by intermediaries (such as retailers or manufacturers) and paid to the government.

Types of Indirect Taxes

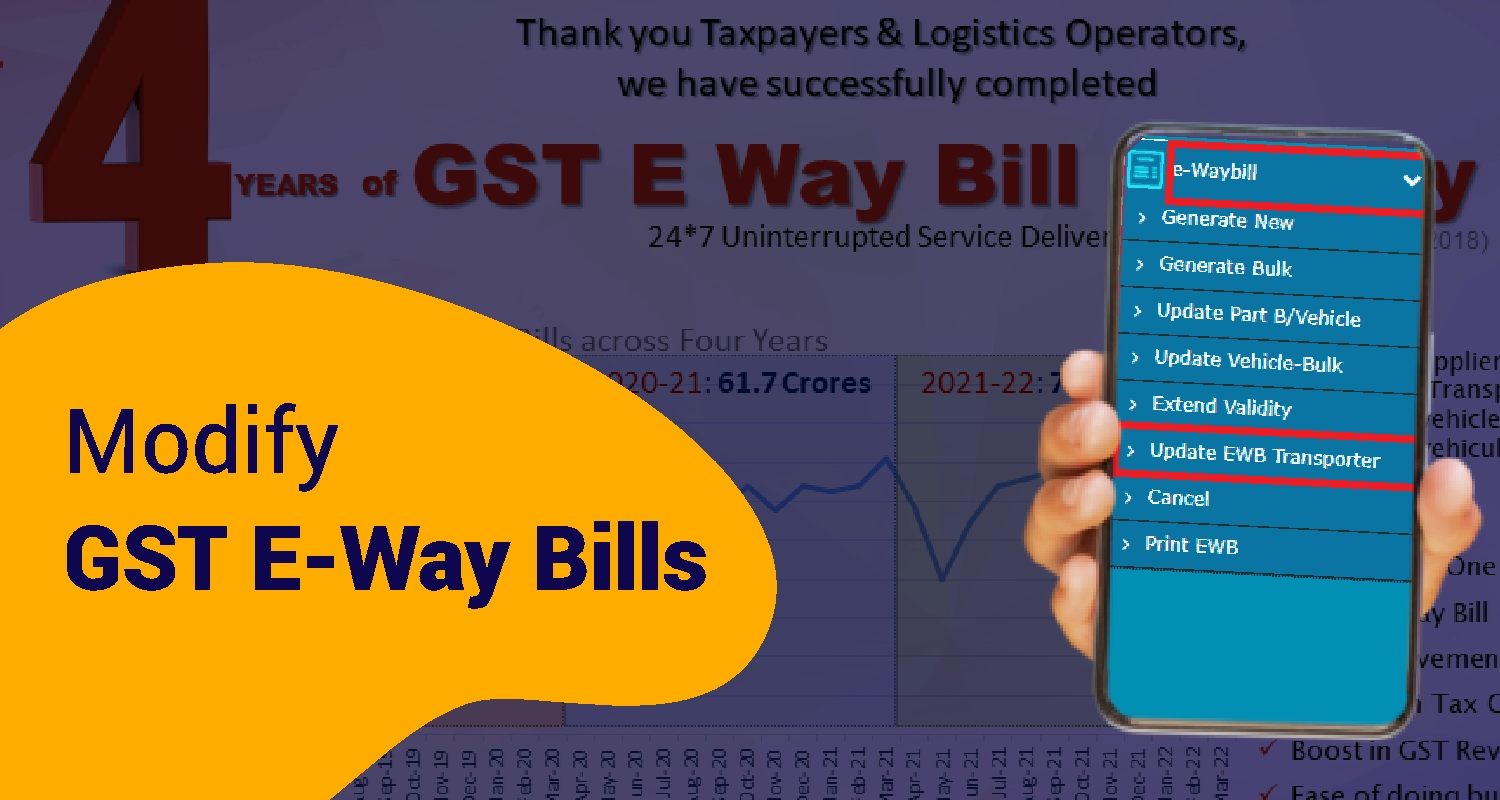

1. Goods and Services Tax (GST)- Introduced in 2017, GST subsumed several indirect taxes like VAT, service tax, and excise duty.

- GST is a unified tax applicable across India, categorized into Integrated GST (IGST), Central GST (CGST) and State GST (SGST) .

- Levied on products coming into or leaving India

- Previously levied on the production of goods within India.

- Earlier charged on services like hospitality, banking, and consultancy.

- Paid on property transactions, legal documents, and certain financial instruments.

- Previously applied to entertainment activities like movie tickets and events.

Key Features of Indirect Taxes

- Paid indirectly by consumers when purchasing goods or services.

- Regarded as regressive, as the rate is uniform regardless of income levels.

- Promotes seamless trade through GST’s "One Nation, One Tax" framework.

Key Differences Between Direct and Indirect Taxes

| Aspect | Direct Taxes | Indirect Taxes |

| Levied on |

Income of Profits |

Goods and Services |

| Paid by |

Individual or Organization |

Consumers (indirectly) |

| Burden Transfer |

Non-Transferable |

Transferable to the end user |

| Example Taxes |

Income tax, Corporate tax |

GST, customs duty |

Tax Implementation in India

1. Direct Taxes Administration- Managed by the Central Board of Direct Taxes (CBDT).

- Taxpayers are required to file returns annually, disclosing their income and taxes paid.

2. Indirect Taxes Administration- Primarily governed by the Goods and Services Tax Council.

- GST returns are filed periodically by businesses to report sales and taxes collected.

Benefits of Understanding Types of Taxation

Knowing the types of taxes in India helps individuals and businesses:

- Ensure timely compliance with tax regulations.

- Avoid penalties for late payments or inaccurate filings.

- Plan financial activities effectively, minimizing tax liabilities where possible.

Conclusion

India’s taxation system is a balance of direct and indirect taxes, each playing a vital role in sustaining the economy. By understanding the nuances of these types of taxes, taxpayers can better navigate their obligations and contribute to the nation’s development.

Familiarize yourself with the types of income tax, the GST framework, and other key tax components to stay compliant and avoid unnecessary complications. Proper awareness empowers both individuals and businesses to manage their finances responsibly in alignment with the law.

FAQs on Types of Taxes

1. What are the main types of taxes in India?Ans. The tax system in India is divided into two main categories:

- Direct Taxes: Taxes levied directly on an individual’s or organization’s income, such as income tax and corporate tax.

- Indirect Taxes: Taxes imposed on goods and services, like GST and customs duty, where the burden is passed on to the consumer.

Ans. The types of income tax include taxes on:

- Salaries

- Income from house property

- Capital gains

- Business profits

- Other sources (e.g., interest or dividends)

These taxes are calculated based on income slabs defined by the government in the Union Budget.

3. What is the difference between direct and indirect taxes?- Direct Taxes: Paid directly by individuals or businesses to the government without intermediaries (e.g., income tax, corporate tax).

- Indirect Taxes: Paid indirectly by consumers when purchasing goods or services, with the tax collected by intermediaries like retailers (e.g., GST, customs duty).

Ans. The is a unified tax introduced in 2017 that replaced multiple indirect taxes like VAT, service tax, and excise duty.

- It streamlines the tax structure into Central GST (CGST), State GST (SGST), and Integrated GST (IGST).

- GST simplifies compliance and promotes seamless trade under the "One Nation, One Tax" principle.

Sapna aapka. Business Loan Humara.

Apply NowDisclaimer: The information contained in this post is for general information purposes only. IIFL Finance Limited (including its associates and affiliates) ("the Company") assumes no liability or responsibility for any errors or omissions in the contents of this post and under no circumstances shall the Company be liable for any damage, loss, injury or disappointment etc. suffered by any reader. All information in this post is provided "as is", with no guarantee of completeness, accuracy, timeliness or of the results etc. obtained from the use of this information, and without warranty of any kind, express or implied, including, but not limited to warranties of performance, merchantability and fitness for a particular purpose. Given the changing nature of laws, rules and regulations, there may be delays, omissions or inaccuracies in the information contained in this post. The information on this post is provided with the understanding that the Company is not herein engaged in rendering legal, accounting, tax, or other professional advice and services. As such, it should not be used as a substitute for consultation with professional accounting, tax, legal or other competent advisers. This post may contain views and opinions which are those of the authors and do not necessarily reflect the official policy or position of any other agency or organization. This post may also contain links to external websites that are not provided or maintained by or in any way affiliated with the Company and the Company does not guarantee the accuracy, relevance, timeliness, or completeness of any information on these external websites. Any/ all (Gold/ Personal/ Business) loan product specifications and information that maybe stated in this post are subject to change from time to time, readers are advised to reach out to the Company for current specifications of the said (Gold/ Personal/ Business) loan.